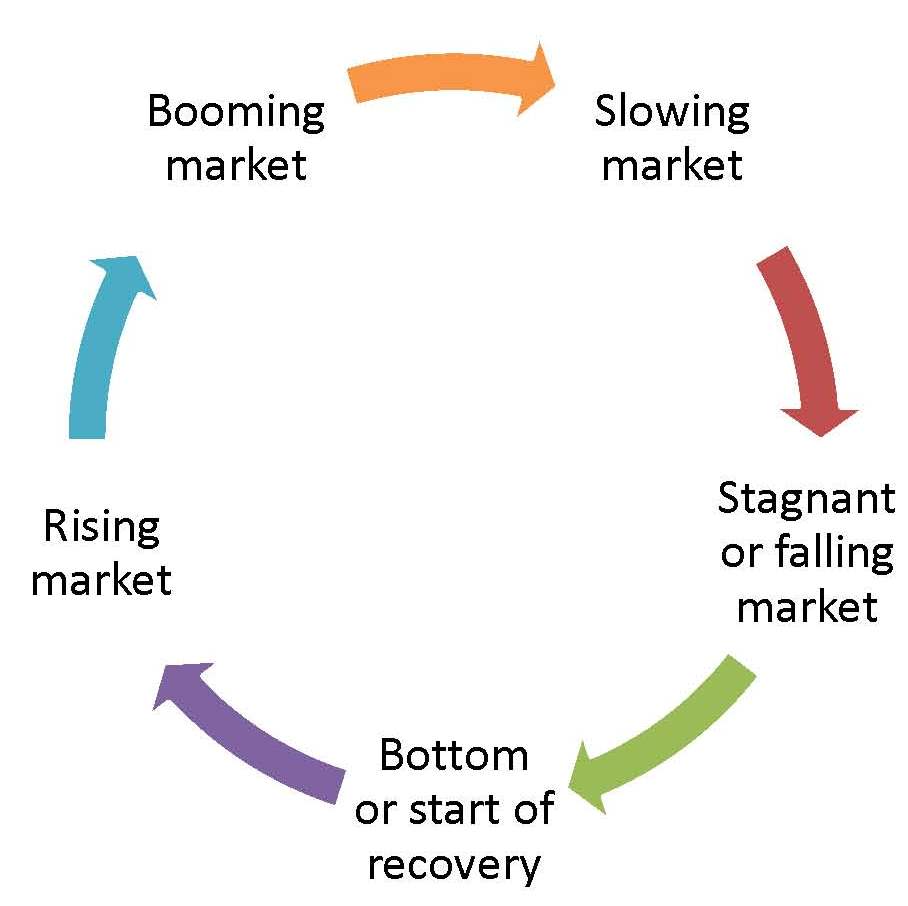

After several years of high mortgage rates and hesitation from buyers, momentum is quietly building beneath the surface of the housing market. Sellers are reappearing. Buyers are re-engaging. And for the first time in what feels like forever, there’s movement happening again. No, it’s not a surge. But it is a shift – and it’s one that could set the stage for a stronger year in 2026. Full...

U.S. Real Estate Market

Home prices rose in 77% of metro markets (176 out of 230) during the third quarter of 2025, according to the National Association of REALTORS®' latest quarterly report. This is up from 75% in the second quarter. Full article here: Home Prices Increased in 77% of Metro Areas in Third Quarter of 2025 (512) 853-0110 or robert@AustinTxHomeSales.com If you are unable to open the...

The number of homeowners trying to sell their home by themselves hit another record low this year—following last year’s previous low. That may be because sellers who go it alone often express regrets, while those who work with a real estate agent report higher sales prices and a far less stressful experience. For Sale By Owner transactions—better known as FSBOs—comprised just 5% of home sales...

Scroll through your feed and you’ll see plenty of finger-pointing about why homes cost so much. And according to a national survey, a lot of people believe big investors are to blame. Even though data shows that’s not true, nearly half of Americans surveyed (48%) think investors are the top reason housing feels so expensive (see graph in article). Full article here: The Reason Homes Feel Like...

A few years ago, inventory hit a record low. Just about anything sold – and fast. But now, there are far more homes on the market. Listings are up almost 20% from this time last year. And in some areas, supply is even back to levels we last saw in 2017–2019. For sellers, that means one thing: Your house needs to stand out and grab attention from day one. Full article here: Why Some Homes Sell...

If you stepped back from your home search over the past few years, you’re not alone – and you’re definitely not out of options. In fact, now might be the ideal time to take another look. With more homes to choose from, prices leveling off in many areas, and mortgage rates easing, today’s market is offering something you haven’t had in a while: options. Experts agree, buyers are in a better spot...

If you’ve seen headlines or social posts calling for a housing crash, it’s easy to wonder if home values are about to take a hit. But here’s the simple truth. The data doesn’t point to a crash. It points to slow, continued growth. And sure, it’s going to vary by local area. Some markets will see prices rise more than others. And some may even see small, short-term declines. But the big picture...

Looking Ahead: Easing Rates and a Potential Market Rebound In recent months, there have been signs of a potential rebound in the housing market. Following the Federal Reserve’s rate cut in September 2025, mortgage rates fell below 6.5% for the first time this year. With additional Fed rate cuts expected in the coming quarters, lower borrowing costs and improving inventory levels could stimulate...

The housing market in the U.S. is in flux, but that hasn’t completely stopped new buyers from entering it. Entry-level homes, or homes built with new homebuyers in mind, have been cropping up all over the country. According to Zonda housing data, these 14 cities are performing at an average level for the entry-level market. And, yes, Austin made the list. Full article here: 14 cities where...

Even as builders continue to grapple with market and macroeconomic uncertainty, sentiment levels posted a solid gain in October as future sales expectations surpassed the 50-point breakeven mark for the first time since last January. Builder confidence in the market for newly built single-family homes was 37 in October, up five points from September and the highest reading since April. Full article...