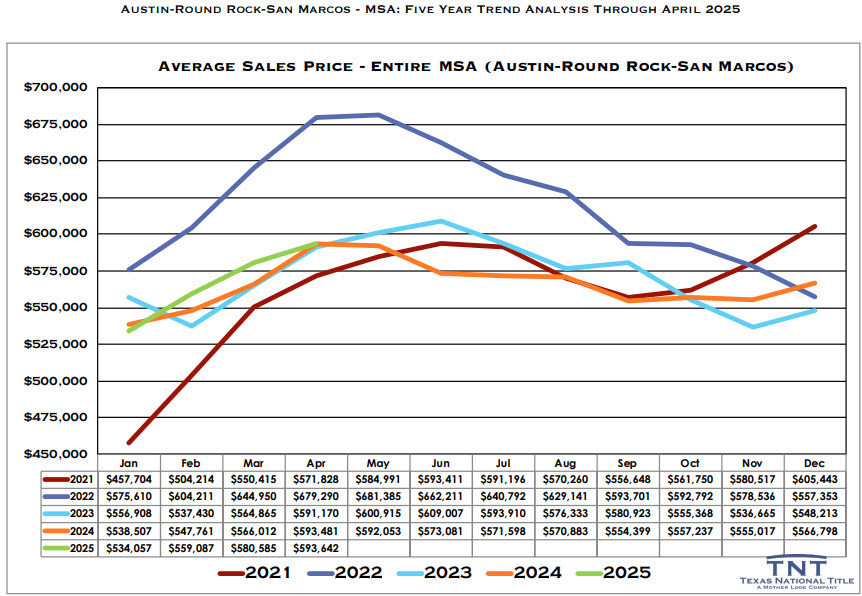

Below are the latest graphs of single-family home sales in the Austin metro spanning the last 5 years. I’ll make some comments above each one, starting with the Average Sales price. You can disregard 2021 since that was the last full year of the “Covid effect” on our local (and national) real estate markets. The first half of 2022 was greatly affected by the Federal Reserve’s dramatic and historic raising of interest rates which led to our stubbornly high mortgage rates. So, comparing 2023-2024 to the 1st 4 months of this year shows our average sales prices have remained mostly steady with each other. Once the Fed finally decides it’s best to lower interest rates and the uncertainty about tariffs is abated, I believe prices will stabilize and begin rising next year.

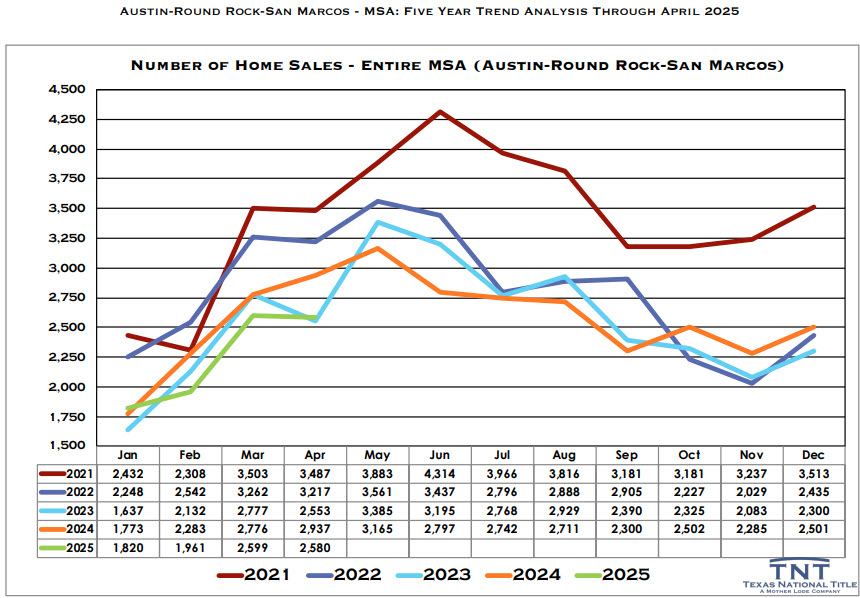

Our number of home sales show similar results–on pace with 2023–though slightly below last year. This, too, should begin to increase as the 2 issues raised above are resolved.

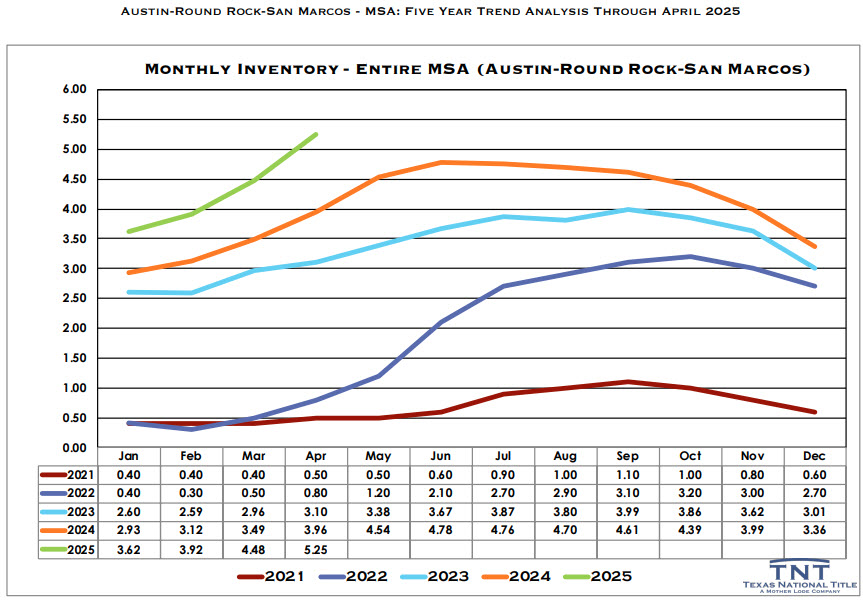

Lastly, home inventory. As a reminder, less than 6 months of inventory (the number of months it would take to sell all homes currently on the market at the current rate) has risen to 5.25 in April, the highest month we’ve seen for April in the past 5 years. In fact, I went back through the numbers and this is the highest April since 2011 when we were coming off the Great Recession. This time, however, I believe it has to do with more sellers deciding to list their homes this year and buyer’s reluctance to purchase due, again, to the 2 issues I raised in the 1st paragraph, above.

The above issues are best recapped in this article about our national real estate market: Buyers gaining advantage in U.S. real estate market The housing market has been on a roller coaster for the past several years, but as the ride slows to a crawl, home prices and some other measures are likely to come back to earth. Home prices surged during the pandemic, but now prices are falling back to earth, and may continue to do so.

(512) 853-0110 or robert@AustinTxHomeSales.com