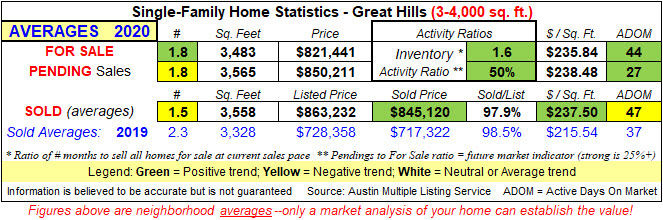

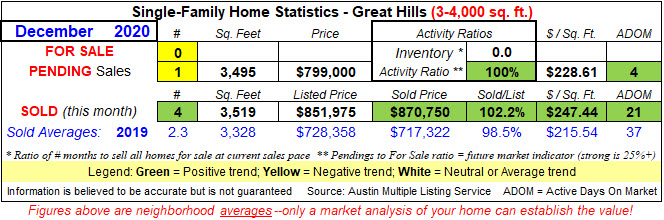

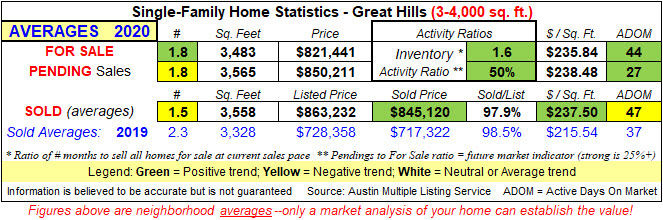

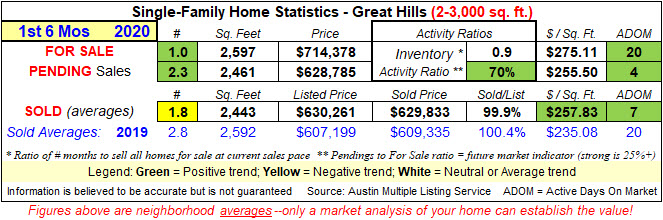

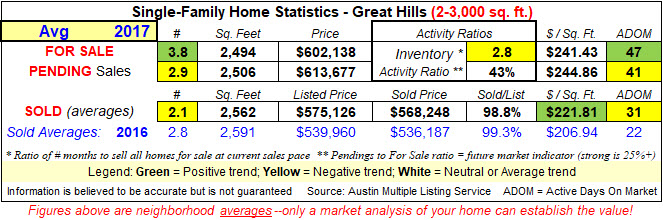

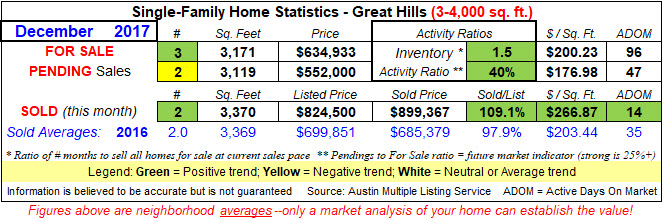

--- Great Hills sales stats

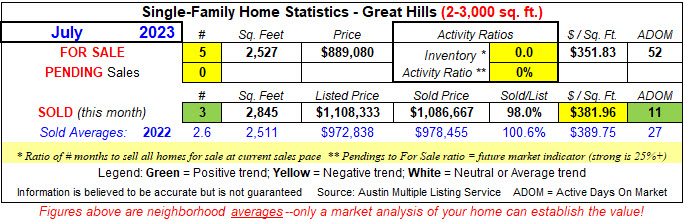

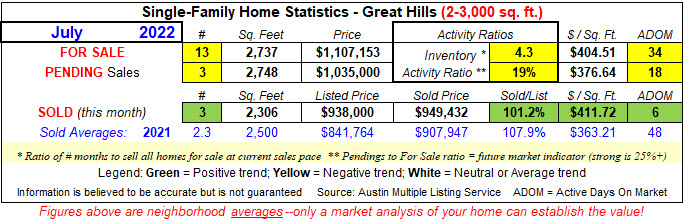

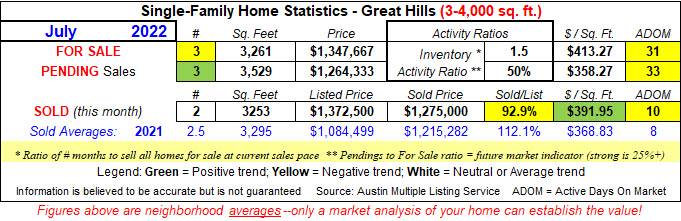

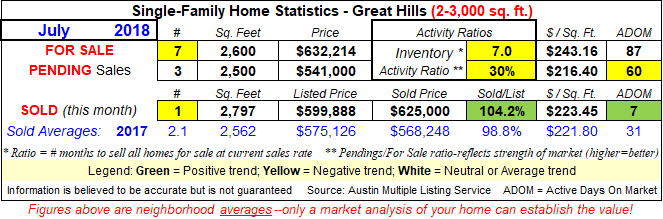

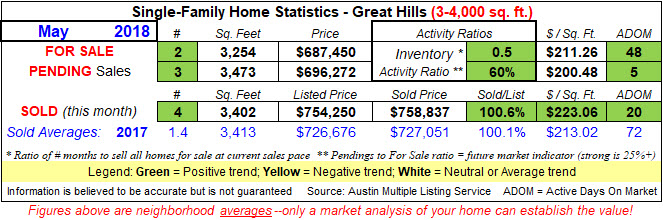

July home sales for our Great Hills neighborhood (2-3k sf homes) slipped some compared to June. We had the same number of home sales, but no pendings which are a future indicator of sales. We are now comparing apples-to-apples when looking at the same month of the previous year since the "Covid effect" is now gone that ended about May/June of 2022. This makes the stats more valid and useful.

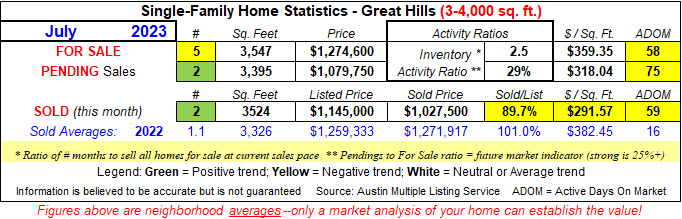

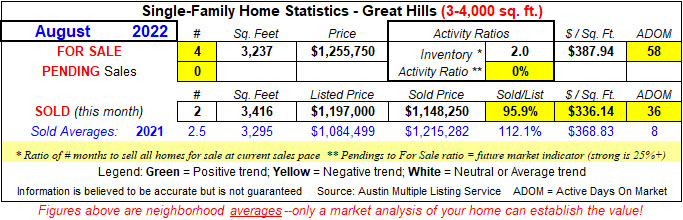

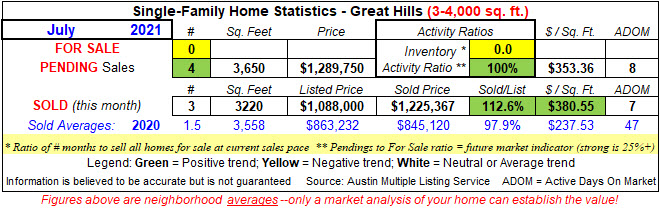

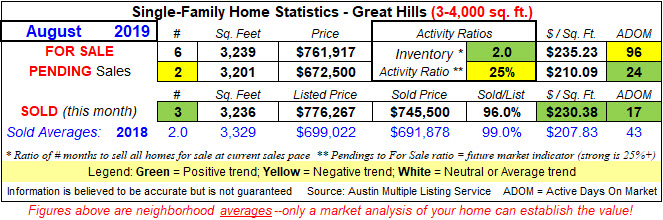

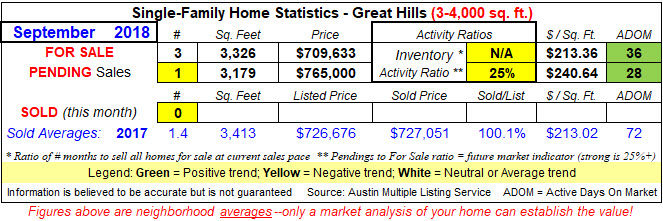

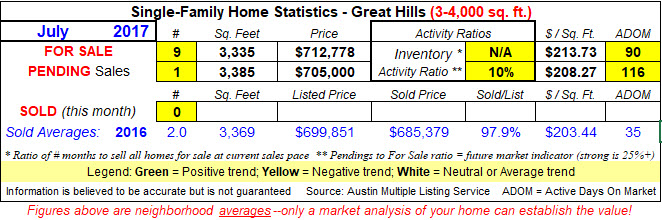

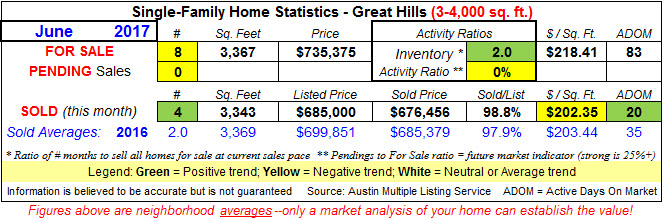

Conversely, larger homes in our neighborhood did better with 2 pendings and 2 home sales. Days on market were all up, however.

It's not too late to put your home on the market this year. In our more typical sales year (ie-before Covid) we would see home listings begin to pick up in March to May (the most popular time to list) with sales continuing through the end of the summer. However due to the last 12 months being a transition period coming out of Covid, we have seen our typical sales cycle shift back a couple of months so I expect a stronger fall than normal. Contact me at 512-853-0110 (call/text) or email robert@AustinTxHomeSales.com if you are considering selling your home this year.

*******************************************************************************************

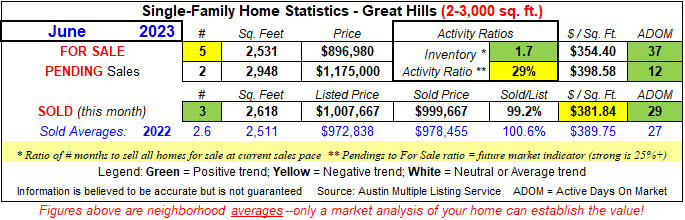

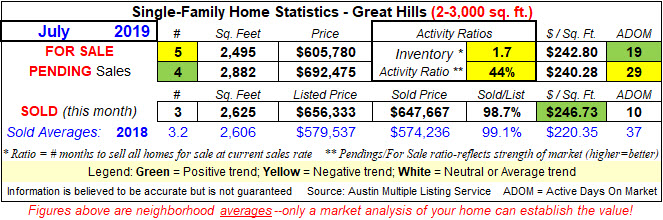

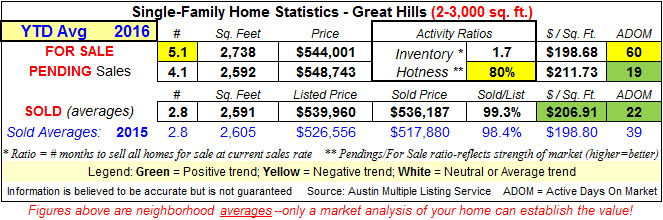

Homes in our Great Hills neighborhood (2-3k sf homes) did well with lower days on the market; only 1.7 months of inventory and we sold 3 homes (nearly 3 times our YTD avg).

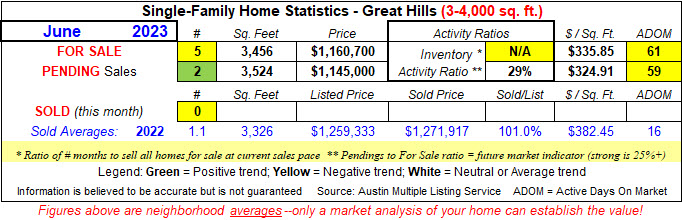

Larger homes in our neighborhood continue to struggle this year overall, but we are averaging 1.33 sales month vs. last year's 1.08.

Now that we are beginning to compare sales figures this year with the

same month last year that wasn't as negatively affected by the rapidly

rising mortgage rates, we may begin to see better numbers overall for

the remainder of this year. For the newsletter I send out to clients,

I've compared the first five months of 2023 with the 5-year average for

these same 5 months of 2022 to better represent the change our Austin

metro has seen the past 12 months or so. Otherwise, we are comparing

apples and oranges since we've had dramatically different markets during

that time.

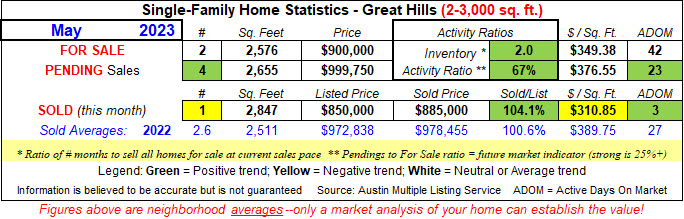

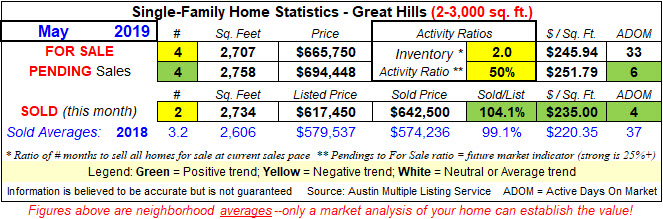

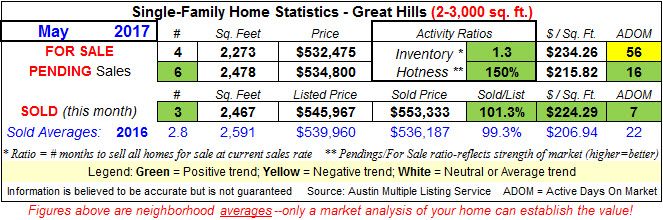

May was somewhat improved over the April numbers in our Great Hills neighborhood (2-3k sf homes) with 6 greens and only 2 yellows. While we only had 1 home sold for the 4th month in a row, there were many positives like only 2 months of inventory; 4 pendings (best of 2023); Activity Ratio was high; our home seller received over asking price for the 3rd month this year; and our days on market dropped. These are positive signs that our Austin metro market has stabilized

from the downturn of last year and even showing signs of coming back to a

more normal Austin single family home sales market. This can be seen in

my recent blog post Austin home sales returning to normal.

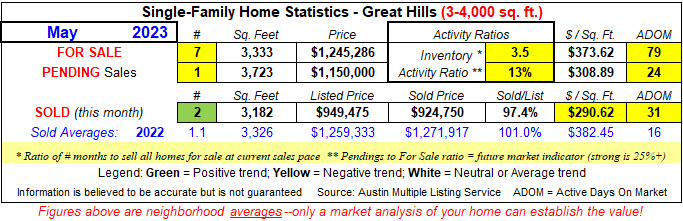

Larger homes in our neighborhood continue to struggle, however, with only 1 green category.

Curious about the current value of your home given the softening of our

market from last year? You can request a quick, one-time

computer generated CMA (Comparative Market Analysis) here: What's My Home Worth?

There is no cost for this service. Or, to request a more detailed CMA

based on your home's location and features, just text or email me at

512-853-0110, robert@AustinTxHomeSales.com. (no cost to you).

**********************************************************************************************

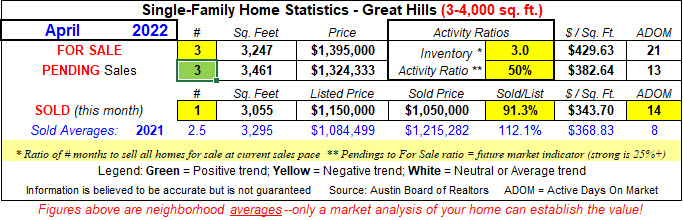

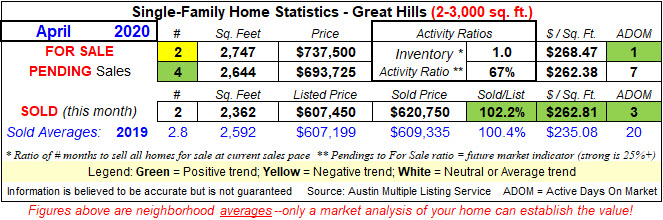

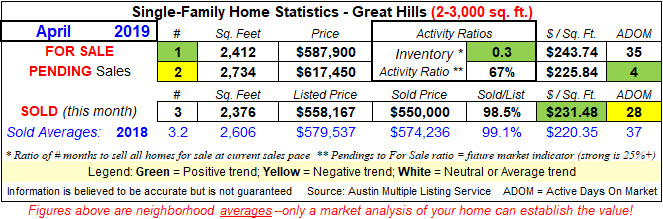

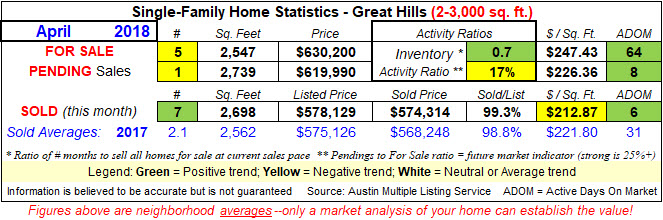

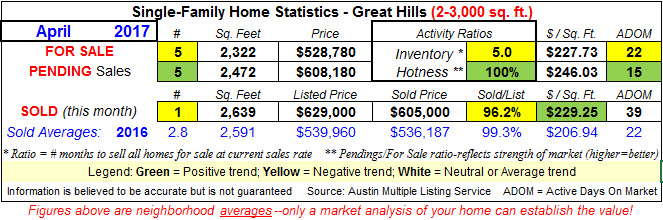

April represented a setback for home sales in our Great Hills neighborhood (2-3k sf homes) with only 1 green category compared to March's five. Not sue what's happening as other NW neighborhoods have steadily improved this year.

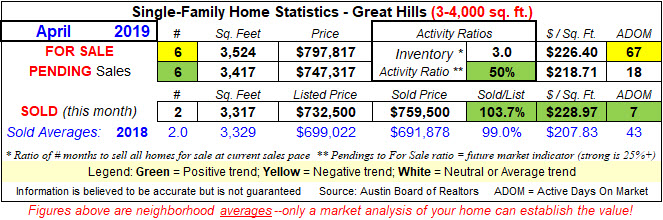

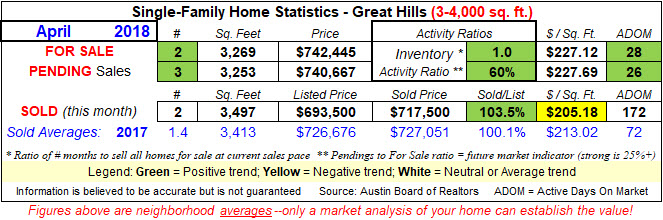

Larger homes in our neighborhood fared the same with lower activity when compared to March. We believe the Austin metro market, as a whole, has reached the

bottom of the downturn we began around June of last year and are

beginning to see slight upticks in activity, too. As interest rate

increases stop (we believe they may have for this year); inflation

subsides and home inventories remail low, we expect this to continue for

the rest of this year and into next.

If you want to know how your home's market value is doing, be sure to get your regular Market Snapshot (free).

This free service pulls data directly from our MLS (Multiple

Listing Service) for similar homes in your neighborhood on a regular

basis (every 2, 4, 6, 8, or 12 weeks) and emails it to you. Create

one yourself for your home here: Market Snapshot. It takes

about 30 minutes to receive your report. Or, let me know if you, or

someone you know, wants me to create a Market Snapshot for their home or

even a traditional CMA (Comparative Market Analysis).

********************************************************************************************

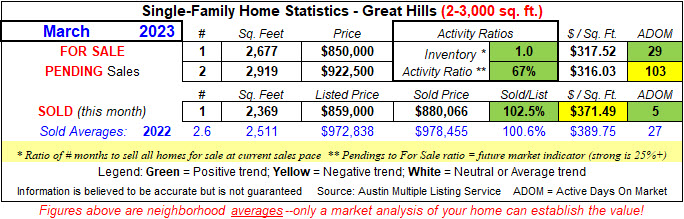

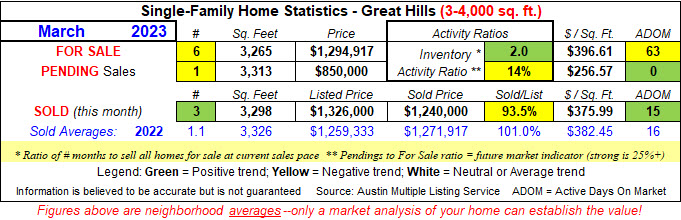

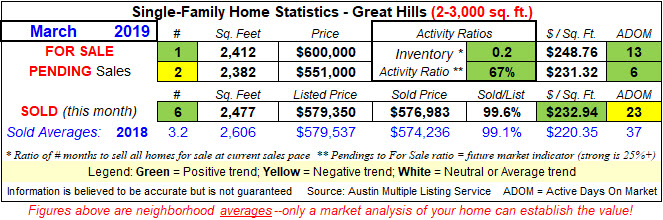

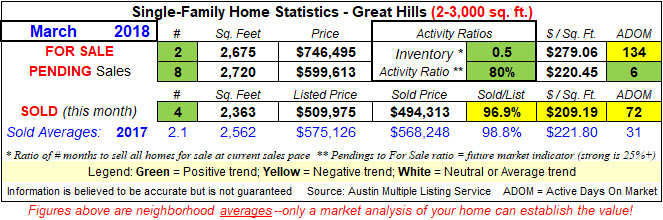

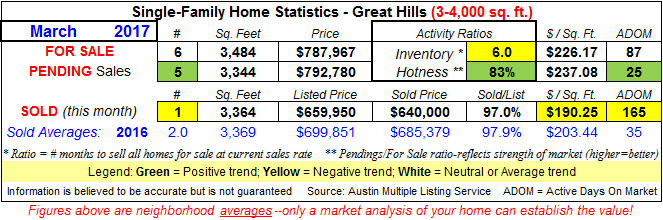

We've gone from 1 (Jan) to 4 (Feb) to 5 (Mar) with green categories in our Great Hills neighborhood (2-3k sf homes) so things are trending in the right direction for home sellers. Each of our 5 greens in March did much better than our 2022 averages: Inventory (-58%); Activity Ratio (+66%); Sold/List ratio (+2%); ADOM for listed homes (-26%) and homes sold (-81%). These are all very positive signs as we get into the strongest part of our traditional selling season of spring to summer.

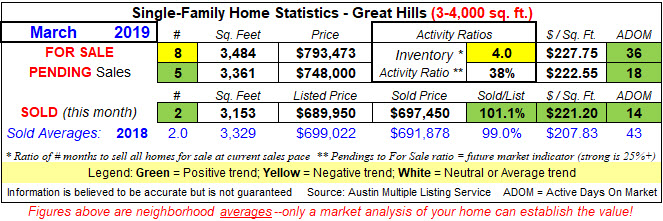

Larger homes in our neighborhood showed improvement, too, but not as pronounced as smaller homes with the exception of our 3 homes sold which is 277% over our 2022 averages. Regardless, we are seeing positive trends vs. the declines we saw that began the 2nd half of 2022.

Curious about the current value of your home given the softening of our

market for the past 6-9 months? You can request a quick, one-time

computer generated CMA (Comparative Market Analysis) here: What's My Home Worth? There is no cost for this service.

******************************************************************************************

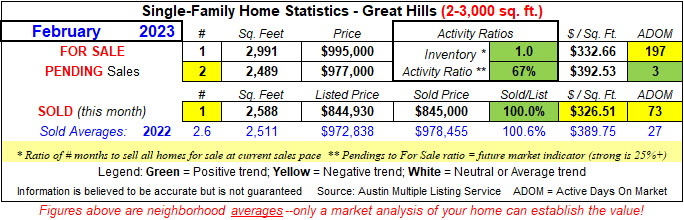

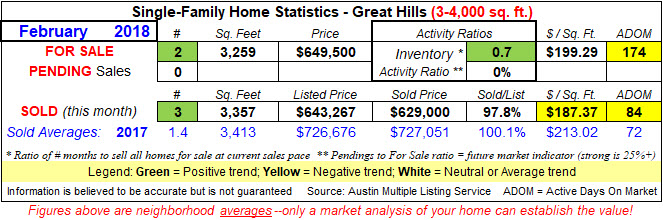

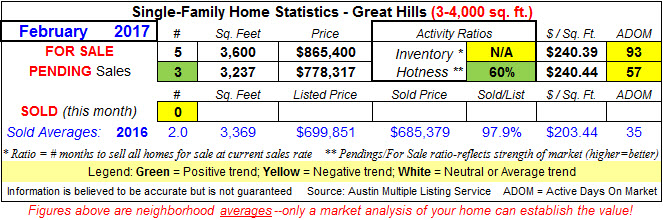

On the one hand, home sales in our Great Hills (2-3k sf homes) neighborhood are

still adjusting to the slowdown we saw the last half of 2022. On the

other hand, the numbers above are comparing to Feb/2022 when our market

was still very hot at the end of our crazy Covid-19 2-year run. So, we

are, in effect comparing apples and oranges due to the big differences

in the markets. However, we are seeing a few more green categories so maybe we are beginning to shake off these effects.

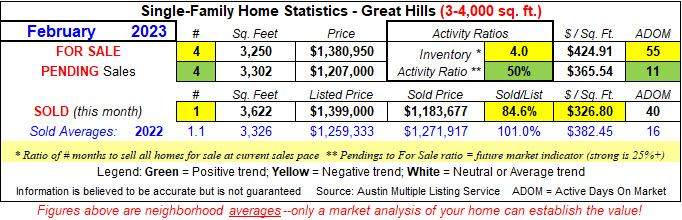

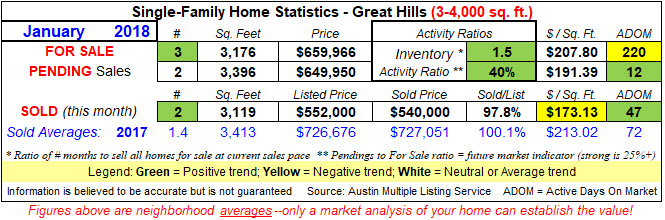

Larger homes in our neighborhood didn't have as many positive numbers last month, but some signs of improvement, nonetheless.

If you want to know how your home's market value is doing, be sure to get your regular Market Snapshot (free). This

free service pulls data directly from our MLS (Multiple Listing

Service) for similar homes in your neighborhood on a regular basis

(every 2, 4, 6, 8, or 12 weeks) and emails it to you. Create one

yourself for your home here: Market Snapshot. It

takes about 30 minutes to receive your report. Or, let me know if you,

or someone you know, wants me to create a Market Snapshot for their home

or even a traditional CMA (Comparative Market Analysis).

**********************************************************************************************

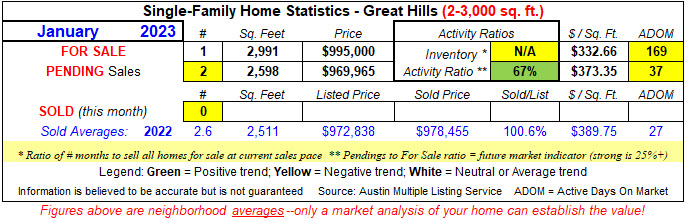

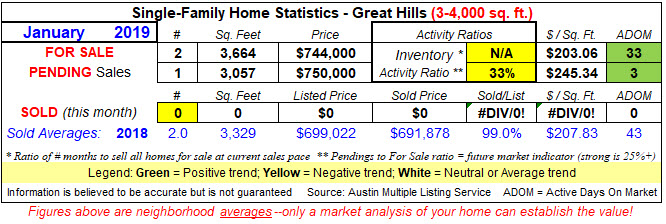

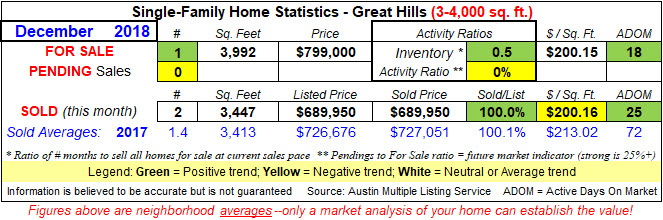

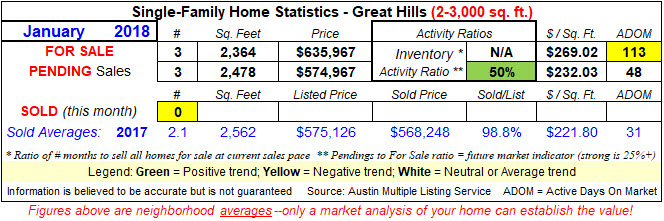

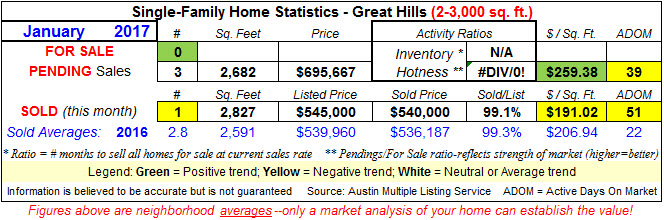

Our Great Hills neighborhood (2-3k sf homes) had a bad start to 2023 with only 1 green category in our January numbers: Activity Ratio. Otherwise, we only had 2 pending sales; longer days on market; and no homes sold while averaging 2.6/mo in 2022.

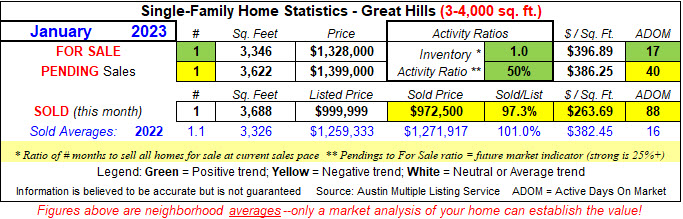

Larger homes in our neighborhood fared a little better with 4 green categories: only 1 home for sale = lower inventory during the slowest part of the year; higher Activity Ratio; lower days on market for our 1 listing; and only 1 month of inventory. However, we had higher days on market with 2 other categories and our 1 home seller received lower price/sf than 2022 seller's received.

I expect to see home prices moderate and even continue some decline for

the early part of 2023 with leveling and slight increases in them as the

year progresses.

Curious about the current value of your home given the softening of our market for the past 6-9 months? You can request a quick, one-time computer generated CMA (Comparative Market Analysis) here: What's My Home Worth? There is no cost for this service.

***********************************************************************************************

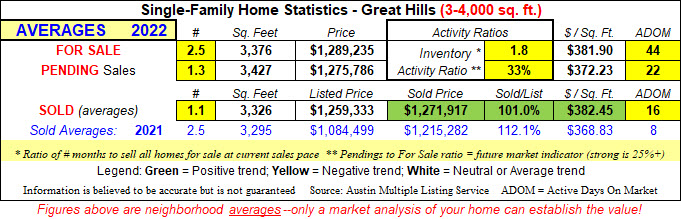

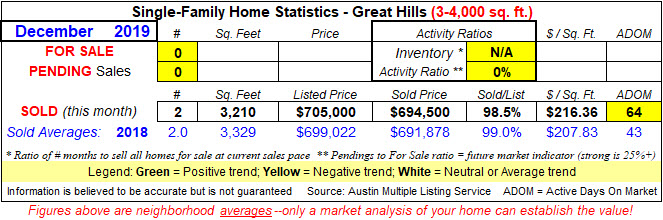

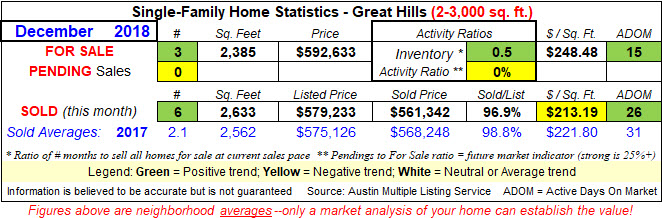

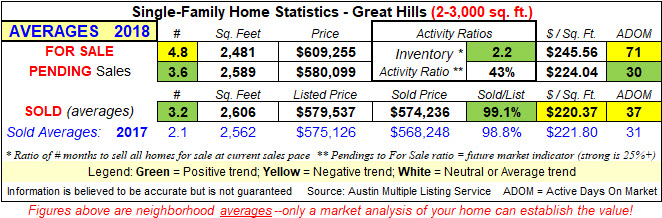

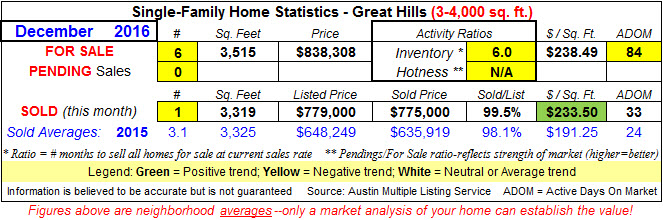

December had 3 green categories in our Great Hills neighborhood (2-3k sf homes) which was the most we've had in a month since July, so that is big news. Our inventory hadn't been at 1.0 or less since May; our Activity Ratio since Apr; and our 3 days on the market since Aug.

Our average for all of 2022, were much better with 8 categories in the green...even our days on the market had 2 and those have been our most consistent yellow category since mortgage interest rates started to slow our market back in June.

Larger homes in our neighborhood fared much worse, unfortunately, with no pending or home sales; and no Activity Ratio, either.

For the whole year, we were able to pull out a couple of green categories: our sellers received an average of $1,271,917 (+5% & $56,634 over 2021) and 1.0% OVER their asking price.

Yes, home listing (asking) prices dropped over the past 6 months or so, but the actual sold prices were up. So, while the media wants to headline "home prices down", they are generally talking about asking vs. sold prices.

If you are considering selling this year, I encourage you to read these 2 articles:

- What Homeowners Want To Know About Selling in Today’s Market

- Ready To Sell? Today’s Housing Supply Gives You Two Opportunities

********************************************************************************************

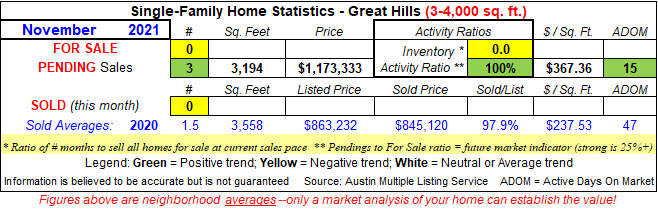

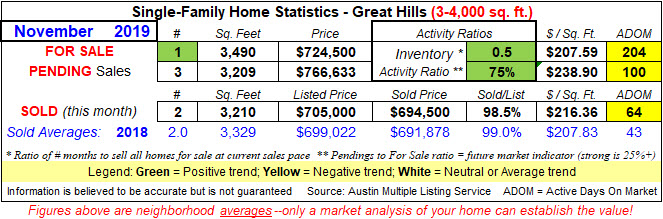

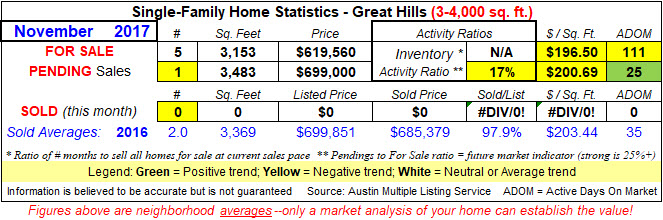

Lack of activity overall was our biggest culprit in November for our Great Hills neighborhood (2-3k size homes)...NO Pending or Sales activity! I had to go back to Nov/2019 to find where this happened in the same month for us. We are barely behind last year's average for home sales (2.27 vs 2.33 last year), so hopefully this will pic up with Decembers' results.

Unfortunately, this isn't a home size issue as it was identical with larger homes in our neighborhood, too.

Just 1 more month to go in 2022 and I'm hoping our Austin metro area is

able to maintain a positive sales price appreciation with December's

numbers. The last time average and median home sale prices dropped for

the entire year in Austin was in 2009 when median prices dropped .7% and

average prices dropped 2%. Median prices, alone, went down .5% in

2011. Before that, it was the late 1980's before Austin home prices

dropped again so it is a rare event, indeed. If you want to know how

your home's market value is doing, be sure to get your regular Market Snapshot (free). This

free service pulls data directly from our MLS (Multiple Listing

Service) for similar homes in your neighborhood on a regular basis

(every 2, 4, 6, 8, or 12 weeks) and emails it to you. Create one

yourself for your home here: Market Snapshot. It

takes about 30 minutes to receive your report. Or, let me know if you,

or someone you know, wants me to create a Market Snapshot for their home

or even a traditional CMA (Comparative Market Analysis).

**********************************************************************************************

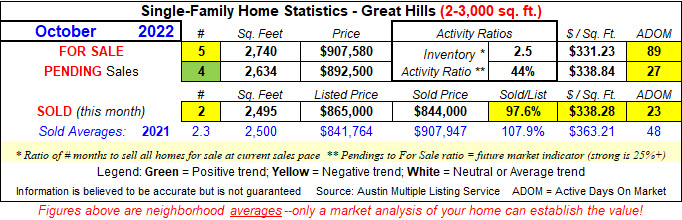

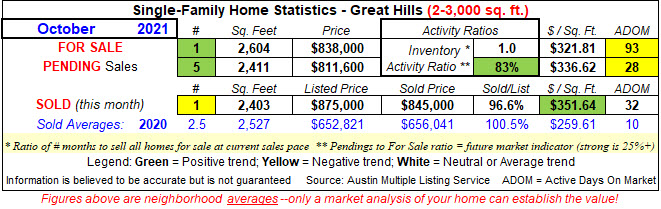

One lone green category for our Great Hills home sales (2-3k sf homes) in October: Pending sales at 4 homes, compared to our 3.9 YTD avg and last year's 2.8 average. Of greater concern, however, is this being the 2nd month-in-a-row where our average price/sf registered below 2021's numbers (-3.9% in September and -6.9% last month).

Sales activity for larger homes in our neighborhood have continued to be anemic the past few months with only 1 pending and 1 home sold for the past 2 months combined.

My best advice to home sellers is that they will need to be extra

vigilant in pricing their home for sale and then be patient until they

get an offer. We have rapidly moved into a more typical, or normal real

estate cycle, and, as of yet, haven't moved into buyer's market

territory (~6+ months of inventory). So, sellers need to get their home

in tip-top shape, stage it well, price it "to the market" (your Realtor

will understand), and market it heavily. Or, simply wait until next

spring when many think we will be past the worst of this downturn.

*****************************************************************************************************

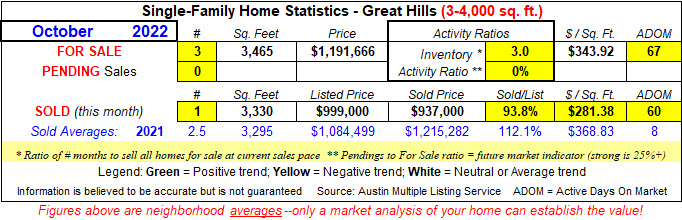

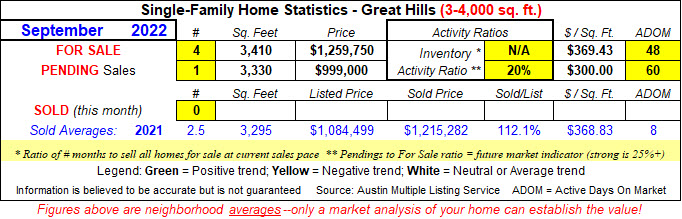

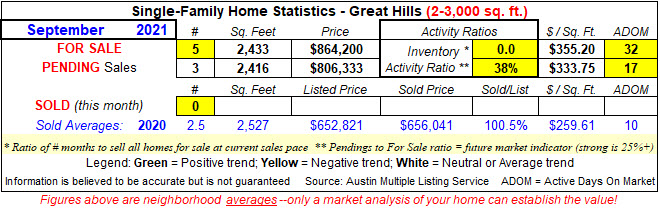

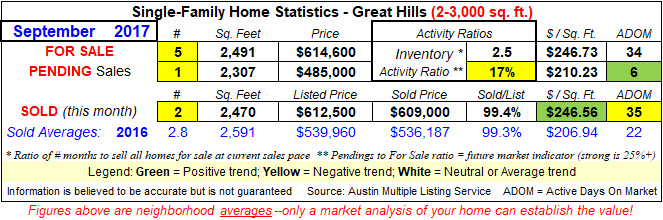

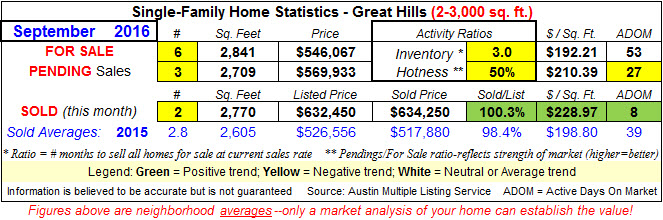

Home sales in our Great Hills neighborhood (2-3k sf homes) had some improvement In September when compared to August...2 green categories in more important areas like pending sales and sold homes. Of biggest concern, however, is our 1st sales price DROP when compared to Sep/2021 of 3.9% (our last month with a decrease was Dec/2020).

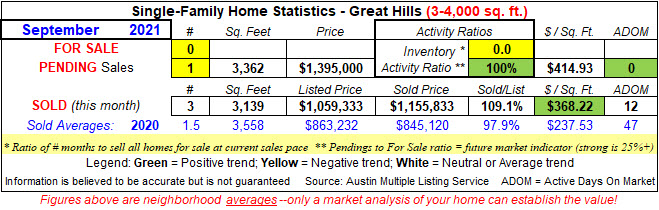

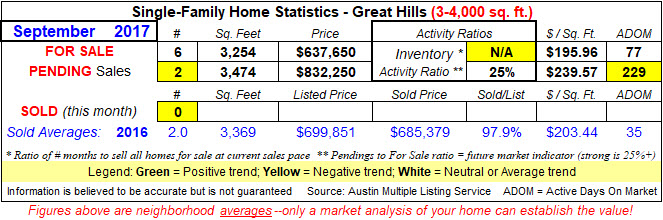

Larger homes in our neighborhood fared worse with no homes sold (1st month since Nov/2021) and only 1 pending sale. Days on market went up, too.

If you are a homeowner and just want a general idea of your home’s

value or to keep up with it during our changing market, I recommend the “Market Snapshot” program. This free service

pulls data directly from our MLS (Multiple Listing Service) for similar

homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12

weeks) and emails it to you. Create one yourself for your home here: Market Snapshot.

It takes about 30 minutes to receive your report. Or, let me know if

you, or someone you know, wants me to create a Market Snapshot for their

home or even a traditional CMA (Comparative Market Analysis).

*****************************************************************************************************

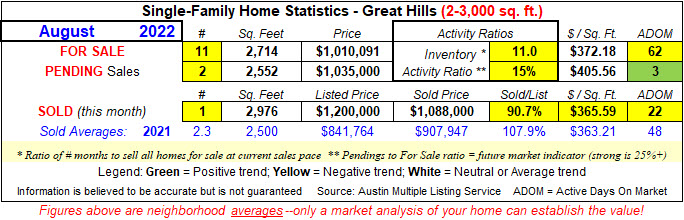

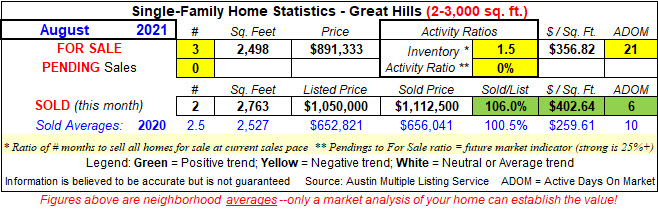

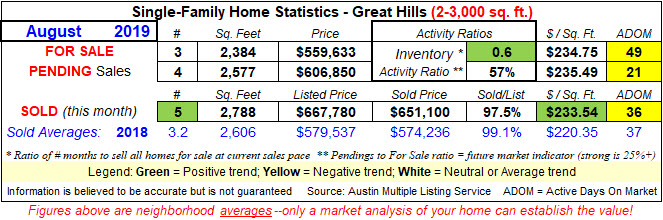

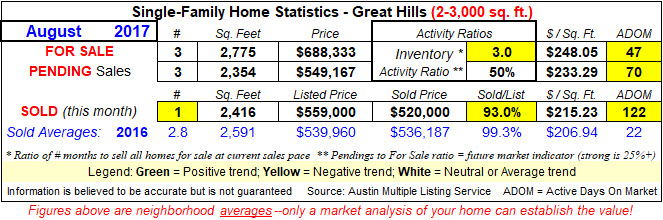

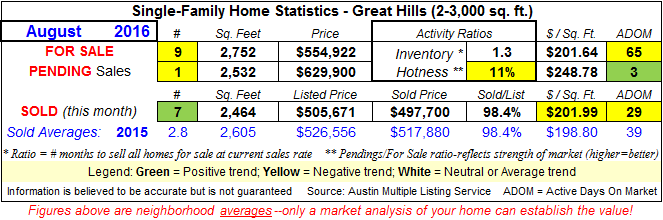

August home sales activity in our Great Hills neighborhood (2-3k sf homes) continued to slow down as we've seen over the past several months. We only managed 1 home sale which sold at $365.59/sf which is .70% over last year's price/sf so we at least had a little bit of appreciation. YTD, however, we have still managed to achieve 18% higher home sales prices than 2021.

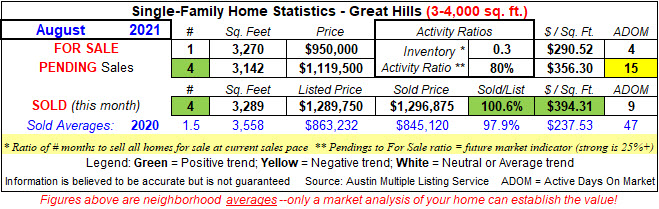

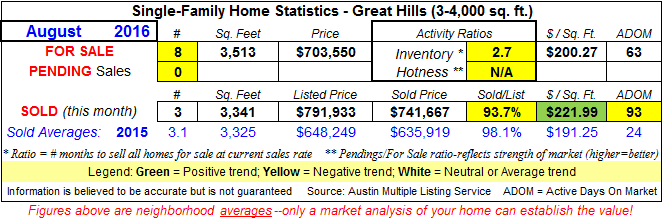

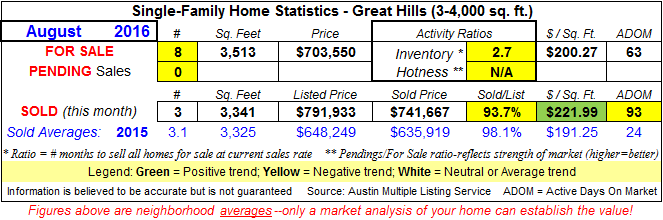

Larger homes in our neighborhood didn't fare any better and our 2 home sellers received 8.9% LESS/sf than 2021 sellers saw and we are up, YTD, 7% in our home sales prices when compared to 2021.

We are now heading into fall which has always been our traditional time

when home sales slow as we move into winter. Our normal home sales

market cycle has been in the shape of a a bell curve with the lowest

activity in January; rising listings/buyers in the spring; peaking

during the summer months (so buyers can relocate their kids to new

schools if necessary); and slowing during the fall/winter months. Most

real estate experts believe (myself included) that the Covid home buying

frenzy is gone and we are now settling into a normal market cycle.

Home sellers would be wise to heed this change and price their homes

according to our slowing activity going forward.

**************************************************************************************************

As I've seen with other NW Austin neighborhoods I monitor, July's home sales numbers for our Great Hills neighborhood (2-3k sf homes) have been slowing down (much like the Austin metro, too) the past 2-3 months. While we had all yellow categories on the front-end activity items, we did manage to eek out 3 home sales who got offers in only 6 days at 1.2% over their asking price (+13.4% over 2021 sellers). So, it was a mixed month for us.

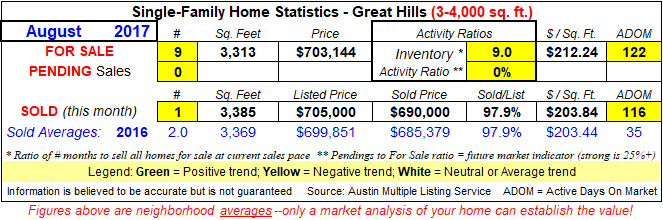

Larger homes in our neighborhood didn't fare quite as well with days on market going up in all 3 categories; a few too many homes for sale and our sellers only received 92.9% of their asking price.

In my opinion after being an Austin Realtor for 16 years is that our

Austin home sales market is like a plane coming in for a landing from a

very high altitude that gently glides to the runway...no abrupt descents

but a slow and steady descent. The home price drops and homes staying

on the market longer you've undoubtedly seen the past 2-3 months are

the result of improper list prices to begin with. For example: Before Covid, Realtors

would run a CMA (comparative market analysis) for a home and list it at

the $500k the CMA showed which was the average of the past 3-5

comparable sales (comps). Sellers expected to receive 95-100% of this

price and, if lucky, would get multiple offers that would push it

higher.

Since Covid (until a few months ago),

however, that same $500k home would have likely received multiple offers

and gone for, say, $600k. Smart sellers and their Realtors realized

they shouldn't price it at the $600k like the last sales and what we did

Before Covid because the $100k runup was the result of "buyer frenzy"

created since Covid...but, at the same $500k the others listed

their home at. This allowed the unpredictable "buyer frenzy" to run up

the price to whatever the last wiling buyer would pay and take into

account the current "buyer frenzy of the day" since Covid has changed

things so much.

Sellers and Realtors who didn't heed this advice

are now "lowering their prices" simply because they thought the buyer

frenzy would last forever, which it has been proved waned the past few

months as mortgage rates shot up and economic uncertainties darken the

horizon. If they had priced at $500k, maybe the buyers would have taken

it to $525k, $550k, $557k, etc and they wouldn't be dropping their

prices, but simply selling their home at a lower price appreciation

rate than sellers got 6+ months ago. Home prices in the Austin metro still rose in June by 13-14% over June/2021 and in our local neighborhood mentioned above, prices also rose relative to July/2022, too. So, the sky isn't falling and Chicken Little will have to wait a little longer! :)

*****************************************************************************************************

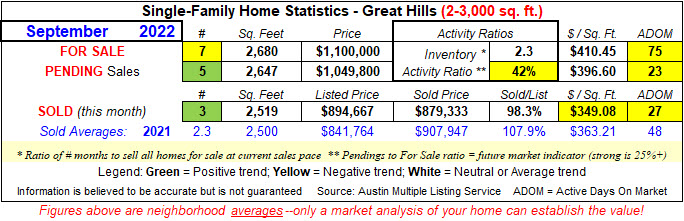

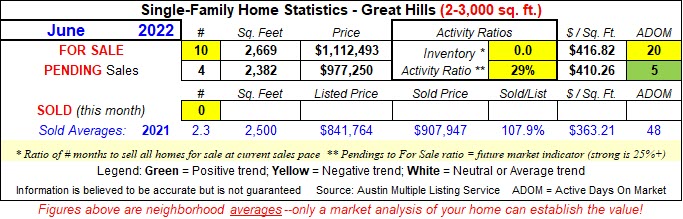

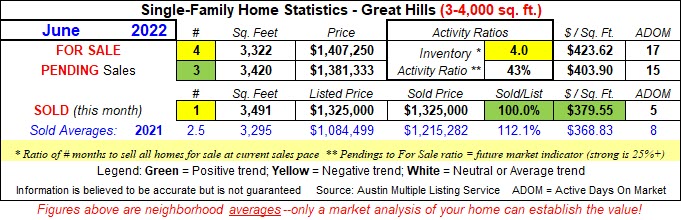

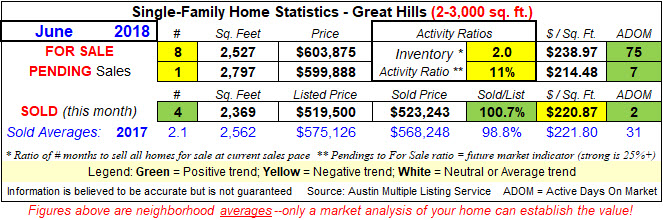

Home sales activity in June in our Great Hills neighborhood (2-3k sf homes) slowed for the 2nd month in a row with only 1 green field (days on market for pendings) and we had no homes sold (our 2nd month this year--January was the other).

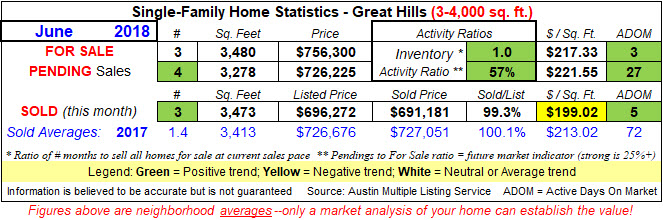

Larger homes (3-4k sf) fared a little better with at least 1 home sale which sold at their asking price.

We've seen a similar trend in our greater Austin metro area beginning in March as mortgage rates began their upward movement from the low we began this year with of 3.22% (5.30% as of 7/7/22). This, coupled with rising inflation and concern about a nationwide recession has rightfully spooked some home buyers. This is reflected in our recent price reductions on some homes currently on the market. So, it is now more important for home sellers to price their home right than it has been since we began our 2-year home sales hot streak after the Covid lockdowns. Contact me if you are thinking about selling your home so I can show you how I do just that for my home sellers so they don't have to "chase the market down" with price reductions.

***************************************************************************************************

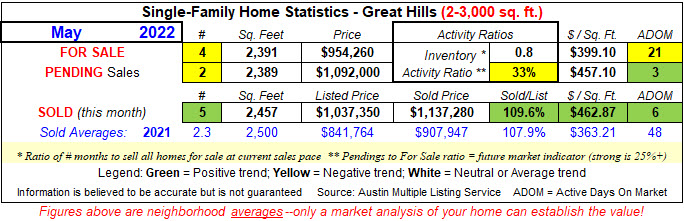

As seen in the other NW Austin neighborhoods I track, home sales activity in our Great Hills neighborhood (2-3k sf homes) slowed on the front-end with too many homes for sale, only 2 pending home sales, lower Activity Ratio and higher days on market. How long this lasts and how deeply it goes will only be discovered as the next few months progress, but I believe it might be somewhat short-lived due to the incredible economy, jobs and demand for housing we have in Austin...one of the best, if not the best city for home sales in the U.S.

Larger homes in our neighborhood had different results with only 2 yellows and 3 green categories (only 1 home for sale; very low inventory at .50 months and above 2022 average price/sf for our home sellers.

As you've seen in my posts since the Covid lockdown, our Austin metro real estate market is setting records with crazy appreciation numbers. So, if you are a homeowner and just want a general idea of your home’s value, I recommend the “Market Snapshot” program. This free service pulls data directly from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to you. Create one yourself for your home here: Market Snapshot. It takes about 30 minutes to receive your report. Or, let me know if you, or someone you know, wants me to create a Market Snapshot for their home or even a traditional CMA (Comparative Market Analysis). Contact me at robert@AustinTxHomeSales.com or 512-853-0110 (phone or text).

You can also request a quick, one-time computer generated CMA here: What's My Home Worth?

**************************************************************************************************

April presented another great home sales month in our Great Hills neighborhood (2-3k sf homes) with: lower days on market (ADOM0 with all 3 categories; 6 pending sales (have contract but not closed); 86% Activity Ratio; and our 3 home sellers received 4.7% over their asking in only 6 days at $417.55/sf (+15% over last year's average).

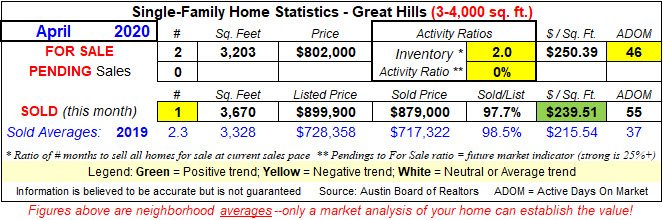

Larger homes in our neighborhood, however, didn't fare well in April with only 1 green category, pending sales which was the same number we averaged each month in 2021. Otherwise, mostly negative results with most categories. This is our 1st really bad month this year, however, so we need to watch to see if this is an aberration or a trend.

Did you know you can exclude most, if not all of the taxable income from the gain on the sale of your home? The IRS allows a seller to exclude from taxable income a gain of up to $250,000 on the sale of their home (or $500,000 if married filing jointly) if they:

-

owned the home and used it as their principal residence during at least two of the last five years before the sale

-

didn’t acquire the home through a 1031 exchange during the past five years

-

didn’t exclude a gain on another home sold during the two years before the current sale

To learn more, see: Excluding Gain from the Sale of Your Home. It might make sense to cash-in on the large equity gain most Austin-area homeowners have seen since the bull market began in spring of 2011. You could then re-leverage the equity into another home and/or investment property. Contact me today by phone/text at (512) 853-0110 or via email at robert@AustinTxHomeSales.com if you would like a free, no-obligation market analysis (CMA) of your home to see how much you would net from the sale.

***************************************************************************************************

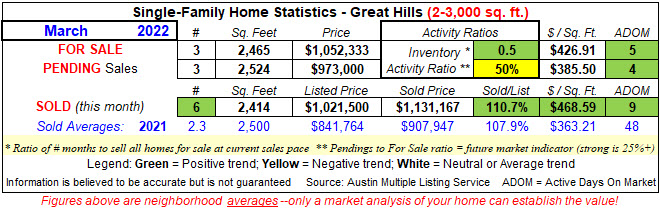

March produced much better numbers for home sales in our Great Hills neighborhood (2-3k sf homes) with only 1 yellow (Activity Ratio) as a negative. Otherwise, our days on market were down in all 3 categories; we sold 6 homes (nearly 3 times our 2.33/mo avg in 2021); our sellers received 10.7% over their asking price and received $468.59/sf, or 29% higher than 2021 sellers received! Also, keep in mind that our home sellers just before Covid hit 2 years ago were getting $244/mo, this represents nearly double the price/sf of only 2 years ago!

March produced much better numbers for home sales in our Great Hills neighborhood (2-3k sf homes) with only 1 yellow (Activity Ratio) as a negative. Otherwise, our days on market were down in all 3 categories; we sold 6 homes (nearly 3 times our 2.33/mo avg in 2021); our sellers received 10.7% over their asking price and received $468.59/sf, or 29% higher than 2021 sellers received! Also, keep in mind that our home sellers just before Covid hit 2 years ago were getting $244/mo, this represents nearly double the price/sf of only 2 years ago!

Larger homes in our neighborhood didn't fare as well with several yellow categories in our For Sale and Pending areas. Our 2 home sellers did quite well, however, with 11% over their asking price at $450.18/sf or 22.1% over what our 2021 sellers received.

Larger homes in our neighborhood didn't fare as well with several yellow categories in our For Sale and Pending areas. Our 2 home sellers did quite well, however, with 11% over their asking price at $450.18/sf or 22.1% over what our 2021 sellers received.

Have you been hounded with calls and/or mailings to buy your home quick…for cash? This might sound like an attractive option until you consider that we now have more buyers for our homes than at any other time in Austin history. So, why would you settle for only ONE offer that might sound good, when you could get multiple offers from buyers bidding up the price in our red-hot Austin market?

Are you concerned that selling your home quickly would only throw you into the pool of frenzied home buyers when looking for your replacement home in the Austin metro and the possibility of not having a place to live once your existing home sells? Well, I have a solution for you where you can buy your next home for cash (so you can compete with other cash buyers), move into it and then sell your home for top dollar using our large pool of buyers! Perfect solution, right? Contact me at 512-853-0110 (call or text) or, robert@AustinTxHomeSales.com to find out more.

**********************************************************************************************

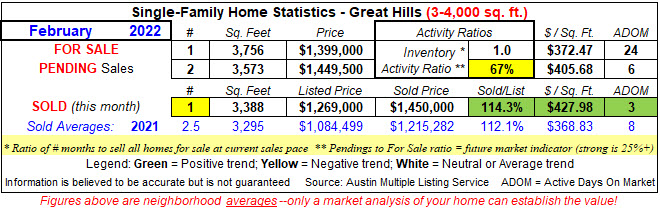

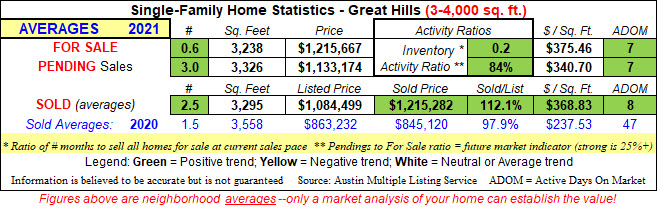

February produced much better numbers for our Great Hills neighborhood (2-3k sf homes) than January did: Low days on market for 2 categories; 7 pending sales (over double our 2.8 avg/mo in 2021); and our 2 home sellers received 2.8% over their asking price at $453.63/sf or nearly 25% over 2021 prices!

Not as much activity, however, for our larger homes with only 1 home selling for the 2nd month in a row vs. our 2.5/mo avg in 2021; only 2 pending sales vs our 3.0/mo 2021 average; and 67% Activity Ratio vs our 84% last year. Our 1 seller did receive 14.3% over their asking price in only 3 days at $427.98/sf or 16% higher than our 2021 sellers received.

As you've seen in my posts since the Covid lockdown, our Austin metro real estate market is setting records with crazy appreciation numbers. So, if you are a homeowner and just want a general idea of your home’s value, I recommend the “Market Snapshot” program. This free service pulls data directly from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to you. Create one yourself for your home here: Market Snapshot.It takes about 30 minutes to receive your report. Or, let me know if you, or someone you know, wants me to create a Market Snapshot for their home or even a traditional CMA (Comparative Market Analysis). Contact me at robert@AustinTxHomeSales.com or 512-853-0110 (phone or text).

You can also request a quick, one-time computer generated CMA here: What's My Home Worth?

*************************************************************************************************

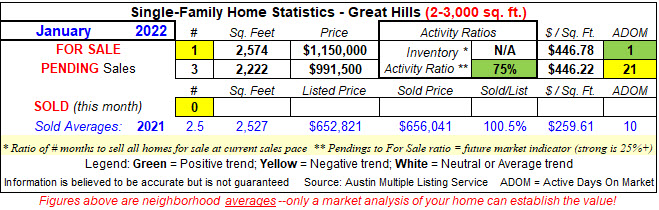

Home sales in our Great Hills neighborhood (2-3k sf homes) were off to a rough start to 2022 in January with very low number in most all of our categories except for Activity ratio which was above 2021 numbers. Ironically, Jan/2021 was a similar start for us and we ended up with a very strong year in 2021 so I believe we will turn it around soon...especially as strong as the Austin metro market has been since Covid-19.

Similar situation for our large homes but at least there was 1 home sale. And, they, too, had an almost identical set of numbers in Jan/2021 with 67% more home sales by the end of 2021 so this isn't anything to be alarmed about.

Have you been hounded with calls and/or mailings to buy your home quick…for cash? This might sound like an attractive option until you consider that we now have more buyers for our homes than at any other time in Austin history. So, why would you settle for only 1 offer that might sound good, when you could get multiple offers from buyers bidding up the price?

Are you concerned that selling your home quickly would only throw you into the pool of frenzied home buyers when looking for your replacement home in the Austin metro and the possibility of not having a place to live once your existing home sells? Well, I have a solution for you where you can buy your next home for cash (so you can compete with other cash buyers), move into it and then sell your home for top dollar using our large pool of buyers! Perfect solution, right? Contact me at 512.853.0110 (call or text) or, robert@AustinTxHomeSales.com to find out more.

***************************************************************************************************

December home sales fell off in our Great Hills neighborhood (2-3k sf homes) compared to November with average home sales; no pending sales; higher days on market (ADOM) and zero Activity ratio. Pricing wasn't affected, however, with our 2 home sellers receiving about 25% more than 2020 sellers received.

December home sales fell off in our Great Hills neighborhood (2-3k sf homes) compared to November with average home sales; no pending sales; higher days on market (ADOM) and zero Activity ratio. Pricing wasn't affected, however, with our 2 home sellers receiving about 25% more than 2020 sellers received.

For all of 2021, we had a mostly average year (ie-no color in box) except for our dramatic drop in inventory from 9 months in 2020 to .90 months last year (down 90%). Also, our pricing continues to go up and we are getting near the $1M average sales price; our $363.21/sf was 40% over 2020 prices and our 28 home sellers received nearly 8% over their asking price.

Larger homes in our neighborhood had a slower month in December, too, with some lower activity numbers, but our $360.52/sf represented an incredible 52% over 2020 prices!

Larger homes in our neighborhood had a slower month in December, too, with some lower activity numbers, but our $360.52/sf represented an incredible 52% over 2020 prices!

For the year, however, our larger homes had outstanding numbers no yellow categories. Days on market were down 75-80+% compared to 2020; inventory was down 88%; number of homes for sale was down 68%; homes sold up 67%; average home price sold up 44%; and our rate of appreciation jumped a phenomenal 442% (55.3% vs. 10.2%).

For the year, however, our larger homes had outstanding numbers no yellow categories. Days on market were down 75-80+% compared to 2020; inventory was down 88%; number of homes for sale was down 68%; homes sold up 67%; average home price sold up 44%; and our rate of appreciation jumped a phenomenal 442% (55.3% vs. 10.2%).

With the new year, many homeowners turn to the possibility of selling

their home. If you are a homeowner and just want a general idea of

your home’s

value, I recommend the “Market Snapshot” program. This free service

pulls data directly from our MLS (Multiple Listing Service) for similar

homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12

weeks) and emails it to you. Create one yourself for your home here: Market Snapshot.

It takes about 30 minutes to receive your report. Or, let me know if

you, or someone you know, wants me to create a Market Snapshot for their

home or even a traditional CMA (Comparative Market Analysis).

************************************************************************************************

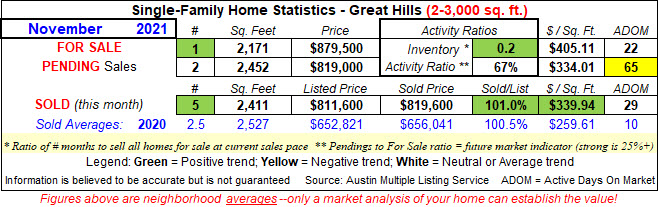

November homes sales in our Great Hills neighborhood (2-3k sf homes) only had 1 yellow with pending home sales taking longer to get under contract. On the positive side, we only had 1 home for sale; .20 months of inventory (our 2nd lowest this year); and sold 5 homes (our 2nd highest of 2021). Also, our sellers got over their asking price at $339.94/sf (31% more than last year's sellers).

Larger homes in our neighborhood didn't fare so well with no homes for sale (no inventory) and no homes sold. We did, however, have a solid month with pendings and Activity ratio.

The general consensus among Realtors and local economists is that our

Austin real estate market is beginning to “normalize” back into what we

usually see each year–a Bell curve of slow sales in January rising in

the spring to a peak in the summer and then gradually going back down to

December. Our inventory remains extremely low at around 1 month for

the Austin metro area so price appreciation will remain higher than

normal until this sufficiently rises. Keep in mind that Austin has

averaged 2-3 months of inventory between 2012 (after we came out of the

Great Recession) until about 18 months ago when our current market surge

started after Covid-19.

******************************************************************************************************************

October was a slightly better month for home sales in our Great Hills neighborhood (2-3k sf homes) vs. September with fewer yellows and 4 green categories. Days on market are still higher which a lot of Austin has experienced the past few months, too, and we only sold 1 home which is half of our YTD average, even though we bounced back from zero home sales in September. On the plus side, we only had 1 home for sale, our Activity Ratio jumped back up and our price/sf was 35.5% more than 2020 sellers received.

Larger homes in our neighborhood fared better with no yellows and we also had only 1 home for sale with 4 pending sales. Also, our 3 home sellers received nearly 12% over their asking price at an incredible $416.85/sf which was 76% more than 2020 sellers received!

Under a typical (ie-”normal”) year, 42% of homes sold in the Austin metro area sell during the 50% of the year from October to March. A common myth is that you have to sell your home during the spring/summer months to have the best chance, but the percentages above prove that wrong. Homes that are in great condition, staged properly, and priced right sell year-round in our area. This year has been anything but “normal” due to the effects of Covid-19, so I fully expect this % to be much higher than our typical real estate cycle which may remain strong through the end of this year. If you are interested in selling your home, see just some of the steps we take to get homes sold quickly and for top dollar: Marketing Plan to Sell Your Home. Call/text us at 512-853-0110 or email us at robert@AustinTxHomeSales.com to get your free, no-obligation market analysis (CMA) and to see how much you can net from your home sale.

****************************************************************************************************************

September homes sales in our Great Hills neighborhood (2-3k sf homes) was clearly the worst of 2021 with 6 yellow categories and no green ones. It was also the 1st month this year with no homes sold. The existing 5 home owners for sale will need to consider dropping their prices since we have only averaged 1.7 homes/mo for sale while 2 months this year had zero homes for sale and 2 had only 1.

Our larger homes fared better, but had the reverse problem with NO homes for sale and there was only 1 pending sale (vs. our YTD 3.1/mo avg). We did have 3 home sales, however, and the sellers received 9.1% over asking price at $368.22/sf which represents 55% more than 2020 sellers received. So, pricing has not been affected by this recent slowdown, but we need to keep an eye on it.

If you are a homeowner and just want a general idea of your home’s value, I recommend the “Market Snapshot” program. This free service pulls data directly from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to you. Create one yourself for your home here: Market Snapshot. It takes about 30 minutes to receive your report. Or, let me know if you, or someone you know, wants me to create a Market Snapshot for their home or even a traditional CMA (Comparative Market Analysis).

*****************************************************************************************************************

Many more yellow categories popped up for August in our Great Hills neighborhood (2-3k sf homes) jumping from 3 of them in July to 5 in August. We’ll see in the coming months whether if this is the future trend in our neighborhood...with the same slowing buyer frenzy Austin has seen the past few months. On the plus side, our 2 home sellers received 6% over their asking price at $403/sf which is an incredible 55% more than 2020 sellers received! And, we had our first average sold price over $1,000,000!

Larger homes (3-4k sf) fared better with only 1 yellow category and good numbers in both pending and sold homes. Our 4 home sellers received just over their asking price and got $394/sf which was 66% OVER 2020's average price/sf!

Under a typical (ie-”normal”) year, 42% of homes sold in the Austin metro area sell during the 50% of the year from October to March. A common myth is that you have to sell your home during the spring/summer months to have the best chance, but the percentages above prove that wrong. Homes that are in great condition, staged properly, and priced right sell year-round in our area. This year has been anything but “normal” due to the effects of Covid-19, so I fully expect this % to be much higher than our typical real estate cycle which may remain strong through the end of this year. If you are interested in selling your home, see just some of the steps we take to get homes sold quickly and for top dollar: Marketing Plan to Sell Your Home. Call/text us at 512-853-0110 or email us at robert@AustinTxHomeSales.com to get your free, no-obligation market analysis (CMA) and to see how much you can net from your home sale.

***************************************************************************

We had more yellows in July for home sales in our Great Hills neighborhood (2-3k sf homes) with increasing inventory (still very low at only 2.0 months) and 1 home sold (vs. our YTD avg of 2.6/mo). This might be a reflection of the market stabilization we’ve seen in the Austin metro the past several months. There are various opinions on whether this is the beginning of a general cool-down in our market or just a temporary lull…I’m still undecided since there hasn’t been enough months of slower activity yet for me to state it is a cool-down.

Larger homes in Great Hills fared better, however with only 2 yellows relating to the fact there were no homes for sale when I ran these numbers. Otherwise, we had many greens with 4 pending home sales; 100% Activity Ratio (the max); and our 3 home sellers received 12.6% over asking price at $380.55/sf (+60.2% over last year's prices). We've also had our 4th month in a row where the average sold price exceeded $1M.

If you are considering selling this year, contact us to receive a free, no obligation market analysis (CMA) for your home. It is not too late in the season to list your home for sale as our local market has been strong for 12 months in a row. Call/text us at 512-853-0110 or by email robert@AustinTxHomeSales.com to receive yours today. See just some of the steps we take to get your home sold quickly and for top dollar: Marketing Plan to Sell Your Home.

**************************************************************************

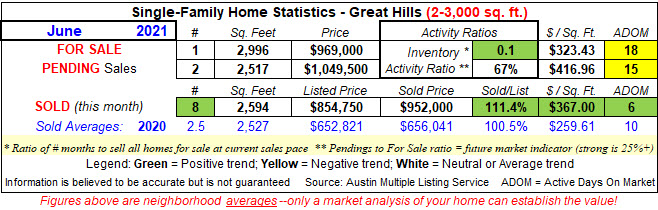

Overall, June was a better month for home sales in our Great Hills neighborhood (homes 2-3k sf) with our best month of 2021 having 8 home sales (282% of our YTD avg!). Also, our inventory dropped to our lowest this year at only .10 months and our home sellers received 11.4% over their asking price in only 6 days at $367/sf (41+% over 2020 prices!).

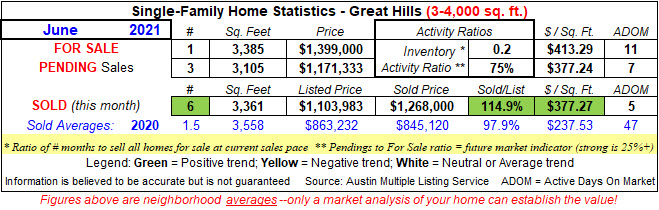

Larger homes in our neighborhood (3-4k sf) had an average month with the exception of our 6 home sellers who got 15% over their asking price at $377.27/sf (+59%!).

As you’ve seen in my posts the past 9 months or so, our Austin metro real estate market is setting records with crazy appreciation numbers. So, if you are a homeowner and just want a general idea of your home’s value, I recommend the “Market Snapshot” program. This free service pulls data directly from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to you. Create one yourself for your home here: Market Snapshot. It takes about 30 minutes to receive your report. Or, let me know if you, or someone you know, wants me to create a Market Snapshot for their home or even a traditional CMA (Comparative Market Analysis).

*******************************************************************************

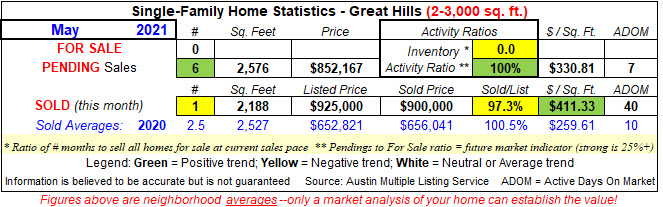

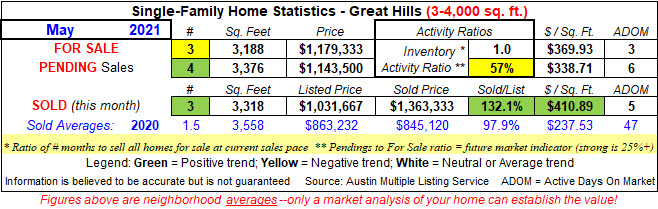

May had mixed results for our Great Hills neighborhood (2-3k sf homes) with only 1 home sale but that seller received $411.33/sf which is 58.5% over 2020 prices! Our rate of appreciation increase over 2020 is nearly 3 times what we did last year. We did have our best pending sales month of the year, however, with 6 homes, double our 2020 monthly rate.

Our larger homes (3-4k sf) fared better with our 2nd month in a row of strong sales activity number for both pending and completed sales. We had 4 pending sales (over twice last year's 1.8/mo avg) and 3 home sales (double last year). Our home sellers received 32.1% over their asking price (best of 2021) at $410.89/sf which was an incredible 73% higher than 2020 sellers received! And, this is our 2nd month in a row that the average home sales price exceeded $1M at $1,363,333! Austin home prices are looking more and more like California's every day.

Are you considering selling your home this year? The incredible buyer frenzy we’ve seen the past 9 months has caused multiple-offers in most situations and 10, 20, 30+% over asking price for many sellers. Unprecedented and historic for the Austin metro area. The most common question I receive is “When will this bubble pop?”. While I don’t have a crystal ball, I do believe it has more time to continue its run, but at a gradually slowing appreciation rate in the coming months. If you are concerned it might turn against sellers soon, contact me so I can run a market analysis (no charge) to see what you can net from the sale of your home and capture your equity to protect it if, indeed, the market does crash.

Call/text me at 512-853-0110 or by email robert@AustinTxHomeSales.com

*********************************************************************************

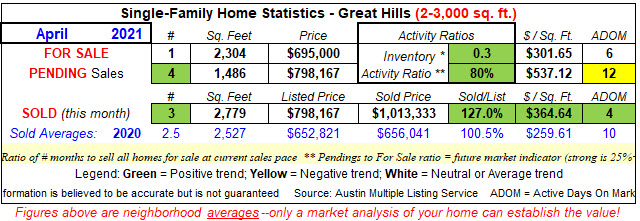

April was a very strong month for our Great Hills neighborhood (2-3k sf homes) with: only .30 months of inventory; 4 pending sales (+33% over YTD); 80% Activity Ratio; and 3 home sales where the owners got 27% OVER their asking price and at an average of 40% more than 2020 sellers received! In fact, we are averaging 37% appreciation thru April this year vs. in 2020!

The pending listings for larger homes in our neighborhood (3-4k sf) finally showed up in April with 5 home sales at 26.9% OVER asking price and a whopping 59% appreciation from 2020 home prices! And, we had 6 pending home sales, too. Maybe the biggest news, however, is that we now have had our 1st million-dollar home listing and sale! Wow, that got here a lot faster than I expected.

Are you considering selling your home, but are concerned that you will have difficulty finding a replacement in the Austin area due to our low inventory? This is a common question we get when asking someone if they want to sell their home and capture the equity. I have several proven methods to handle the changeover for you to reduce any stress associated with the sale of your home & purchase of the next one. Contact me today so we can go over the best option for your situation. Phone/text: 512-853-0110 or via email: robert@AustinTxHomeSales.com.

****************************************************************************

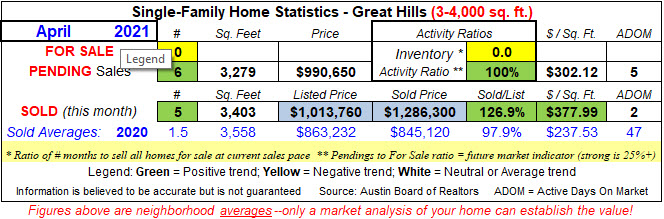

March home sales in our Great Hills neighborhood (2-3k sf homes) fell off some in March with a few more yellow categories like higher inventory; only 1 home sale; and our 2 homes for sale have been on the market for 13 days. On the plus side, our days on market were down for 2 categories; and our 1 home seller received an incredible 41.9% MORE than asking at an impressive $487.33/sf which was nearly 90% MORE than 2020 sellers received!

It was a tough month for our larger homes (3-4k sf) with no homes for sale and no homes sold. However, we did have an incredible 4 homes pending (over twice our monthly average in 2020); our Activity ratio was 100% (2nd month in a row and the maximum possible amount) and the sellers got offers in only 4 days.

If you are considering selling this year, contact us to receive a free, no obligation market analysis (CMA) for your home. March, April & May are the most popular months to list a home for sale. Call/text us at 512-853-0110 or by email robert@AustinTxHomeSales.com to receive yours today. See just some of the steps we take to get your home sold quickly and for top dollar: Marketing Plan to Sell Your Home.

*****************************************************************************

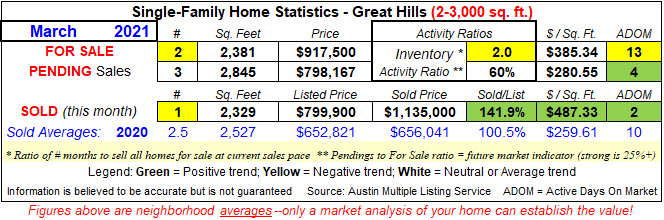

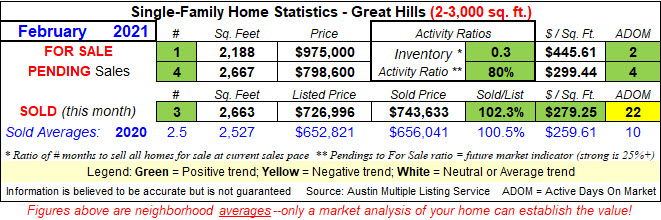

Home sales in our Great Hills neighborhood (2-3k sf homes) bounced back nicely from a low activity month in January with: 4 pending sales (+33% from 2020 avg); 80% activity ratio which is the highest possible; 3 home sales and the sellers received 2.3% OVER their asking price at an average of $279.25 which is 7.6% over 2020's average sales price.

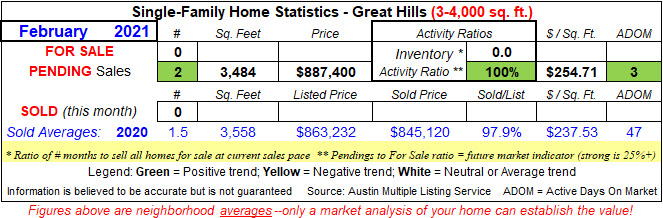

Larger homes (3-4k sf) in our neighborhood didn't fare as well with no homes for sale and no homes sold. But, we did have 2 pending homes that got offers in only 3 days which is a 100% Activity ratio (the highest possible).

As you’ve seen in my posts the past 6 months or so, our Austin metro real estate market is setting records with crazy appreciation numbers. So, if you are a homeowner and just want a general idea of your home’s value, I recommend the “Market Snapshot” program. This free service pulls data directly from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to you. Create one yourself for your home here: Market Snapshot. It takes about 30 minutes to receive your report. Or, let me know if you, or someone you know, wants me to create a Market Snapshot for their home or even a traditional CMA (Comparative Market Analysis).

**************************************************************************

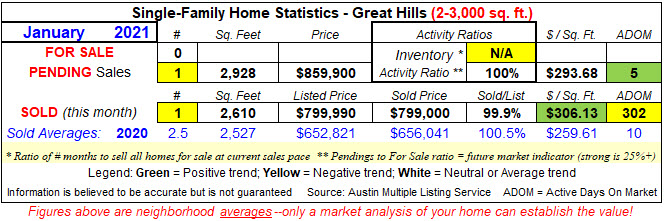

January numbers are mixed to start 2021 in our Great Hills neighborhood with: NO homes for sale (out of about 1,168 homes); 1 pending (vs. 3/mo avg in 2020); and 1 sale (vs. 2.5/mo in 2020). The 302 days on the market were due to this home being new construction which typically goes in the MLS during the slab stage.

Larger homes didn't fare any better, though, with no homes for sale or pending so no inventory and no activity. Our 1 seller did get 5.1% OVER their asking price in only 4 days.

You may have heard that the past few months have been red-hot for sellers in the entire Austin metro area (5 counties and about 2.2M people)…multiple offers and 10-20% over asking price is more the norm now! So, if you have been putting off selling because you need to do some updates; don’t want to deal with the hassle of handling showings of your home; need more time to find a replacement home once yours sells; have been concerned the net amount you would take home at closing isn’t enough; etc…please contact me so I can show you we now have solutions for any/all of the above situations!

Call/text me at 512-853-0110 or by email robert@AustinTxHomeSales.com so I can understand your situation and provide you with solutions that will alleviate your concerns!

************************************************************************

December didn't end 2020 very well for us in Great Hills (2-3k sf homes) with too many yellow categories: no homes for sale; only 1 home sold; that seller took 32 days to get an offer and sold for less than our YTD avg of 100.5% at a price/sf that was lower, too.

We ended 2020 better, however, with more greens and only 2 yellows...in spite of the fact that Austin was shut down for about 2 months due to Covid-19.

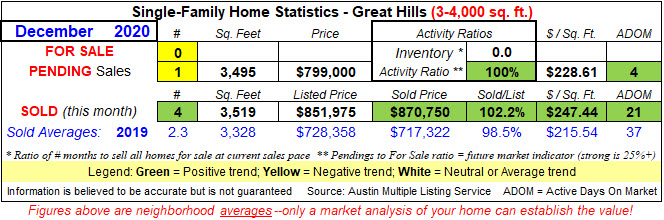

Larger homes (3-4k sf) fared better than smaller ones in December with only 1 Pending and no homes for sale (common in Austin lately) and greens in Activity Ratio (100% & the highest possible); days on market in 2 categories; and our 4 home sellers sold quicker and got 2.2% OVER their asking price.

Our larger homes fared mostly well with pendings and sales down some, but inventory way down, days on market down in 2 categories and sellers got 10.2% more/sf than 2019 sellers received.

If you are considering selling this year, contact us to receive a free, no obligation market analysis (CMA) for your home. March, April & May are the most popular months to list a home for sale. Call/text us at 512-853-0110 or by email robert@AustinTxHomeSales.com to receive yours today. See just some of the steps we take to get your home sold quickly and for top dollar: Marketing Plan to Sell Your Home.

**************************************************************************

November was a mixed bag of results in our Great Hills neighborhood (2-3k sq ft homes)...on the down side, we have too many homes going into the slower winter months which have been on the market a long time; we only had 1 pending sale (vs. our 2.9/mo YTD avg) and they were on the market for 32 days (vs. our 9/mo YTD avg) and our Activity Ratio dropped to only 25%. However, we only have .60 months of inventory; 5 homes sold (189% of our YTD avg) at 4.3% OVER asking price at an impressive $287.25/sf (+22.2% over 2019 sales)!

Larger homes in our neighborhood (3-4k sq ft), however, had the best month of 2020 with: 4 pending sales (222% of our YTD avg); days on market dropped in 2 categories; we had a 100% Activity Ratio (the highest possible) and sold 2 homes (157% of our YTD avg) at 30.6% MORE than 2019 sellers received at $281.62/sf.!

Did you know you can exclude most, if not all of the taxable income from the gain on the sale of your home? The IRS allows a seller to exclude from taxable income a gain of up to $250,000 on the sale of their home (or $500,000 if married filing jointly) if they:

-

owned the home and used it as their principal residence during at least two of the last five years before the sale

-

didn’t acquire the home through a 1031 exchange during the past five years

-

didn’t exclude a gain on another home sold during the two years before the current sale

To learn more, see: Excluding Gain from the Sale of Your Home. It might make sense to cash-in on the large equity gain most Austin-area homeowners have seen since the bull market began in spring of 2011. Contact us today by phone/text at (512) 853-0110 or via email at robert@AustinTxHomeSales.com if you would like a free, no-obligation market analysis (CMA) of your home to see how much you would net from the sale.

***************************************************************************

Overall, October was a good month for home sales in our Great Hills neighborhood (2-3k sf homes) with: 5 pending home sales (our highest this month); and, our 3 home sellers received 6.4% OVER their asking price at an incredible $273.78/sf (+16.5% over 2019 sellers). Our only real negatives were higher days on market and a few too many homes on the market going into our typically slower winter months.

Larger homes (3-4k sf) had an OK month with 5 pending sales (67% over our best month this year); 100% Activity Ratio (the highest possible); and we sold 2 homes (+67% over our YTD avg). We don't have any homes for sale, unfortunately.

For those home sellers who just want a general idea of their home’s value, we recommend the “Market Snapshot” program. This free service pulls data from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to the homeowner. Create one yourself for your home here: Market Snapshot. It takes about 30 minutes to receive your report. Or, let us know if you, or someone you know, wants me to create a Market Snapshot for their home or even a traditional CMA (Comparative Market Analysis).

************************************************************************

September represented a slight drop off from August home sales in our Great Hills neighborhood (2-3k sf homes): 4 homes for sale (vs. 1.6/mo YTD avg); 2.0 months of inventory (double our YTD avg); 50% Activity Ratio (30% below our YTD avg)...however, we did have 4 pending sales (+38% of our YTD avg); and our 2 sellers got 15.1% more/sf than 2019 sellers and in only 4 days.

Larger homes (ie-3-4k sf homes) fared about the same with too many homes for sale and 67% longer to get to pending contracts. But, we did have 2 pending sales (+67% over YTD avg) and our 2 sellers (+80% of YTD avg) got offers in half the number of days as our YTD average.

************************************************************************

August was a very good one for home sales in our Great Hills neighborhood (2-3k sf homes) with: 4 pending listings (+43% over YTD avg); 4 home sales (+68% over YTD avg); our sellers got 3.3% OVER asking price at 9.8% MORE/sf than last years sellers.

Our larger homes didn't fare as well with a few too many listings and no home sales, but we do have 3 pendings (+272% over YTD avg) and a 50% Activity Ratio (+51% over YTD avg).

Under a typical (ie-”normal”) year, 42% of homes sold in the Austin metro area sell during the 50% of the year from October to March. A common myth is that you have to sell your home during the spring/summer months to have the best chance, but the percentages above prove that wrong. Homes that are in great condition, staged properly, and priced right sell year-round in our area. This year has been anything but “normal” due to the effects of Covid-19, so I fully expect this % to be much higher than our typical real estate cycle which may remain strong through the end of this year. If you are interested in selling your home, see just some of the steps we take to get homes sold quickly and for top dollar: Marketing Plan to Sell Your Home. Call/text us at 512-853-0110 or email us at robert@AustinTxHomeSales.com to get your free, no-obligation market analysis (CMA) and to see how much you can net from your home sale.

**************************************************************************

July was the best month for home sales stats in our Great Hills neighborhood (homes sized 2-3k sf) this year: only 1 home for sale; .30 months of inventory (vs. our .80 YTD avg); 4 pending sales (vs. our 2.6/mo YTD avg); 80% Activity ratio; and 4 home sales (almost double our YTD avg) where the owners got 5.2% more/sf than last years sellers.

Larger homes (3-4k sf) in our neighborhood also fared well with: 8 pending sales (over double our YTD avg); 62% Activity ratio (1/3 higher than our YTD avg); and our 3 home sellers got $221.99/sf (+10.5% over last year!).

For those home sellers who aren’t sure about selling this year, or just want a general idea of their home’s value, we recommend the “Market Snapshot” program. This free service pulls data from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to the homeowner. Create one yourself for your home here: Market Snapshot. It takes about 30 minutes to receive your report. Or, let us know if you–or someone you know–wants me to create a Market Snapshot for their home.

**********************************************************************

June wasn't a great month for home sales in our Great Hills neighborhood (2-3k sf homes) with 3 homes for sale (3x our monthly avg); days on market were high in 2 categories; inventory went up; and our Activity ratio dropped. our 2 home sellers did get .4% OVER their asking price at $255.96/sf (+8.9% over 2019) in only 3 days.

Since June marks the halfway mark of the year, how did we fare given that COVID-19 began affecting us in Feb/Mar? As you can see below, we did incredibly well:

For larger homes:

Even though there were several yellows for larger home sales (3-4k sf) in our neighborhood, the important activity categories did well: 3 pending sales was nearly 4 time our YTD avg; Activity ration nearly doubled our YTD avg at 50%; and our 1 home seller got an incredible $268.38/sf (+24.5% over 2019 avg).

Since June marks the halfway mark of the year, how did we fare given that COVID-19 began affecting us in Feb/Mar? As you can see below, we had a mixed bag of results:

Do you have an appreciation gain in a piece of real estate that isn’t your primary residence (it must be held for investment purposes) that you would like to sell, but don’t want to pay the capital gains taxes? Did you know there is an easy way to avoid these taxes in this situation? 1031 Tax-Deferred Exchanges have been around since 1921 and allow you to do just that. These gains can be deferred again and again if you sell that property in the future.

I personally did this when I sold a piece of Austin commercial real estate property I co-owned in 2006 and was able to parlay most of my profit (I took some in cash, called “boot”) into two rent houses. I didn’t pay taxes on the sale of the commercial property, but simply deferred it into the future. Since I plan to use the rent houses as retirement supplement, I don’t plan to ever sell them so there would be no taxes due until my death when they would become part of my estate. 1031 Exchanges can be done with any “like-kind” property which is very broad and can include investment real estate, vacation houses, raw land, oil & gas, etc. I have a contact with someone who does these exchanges and their company has completed over 160,000 exchanges…call me and I’ll be happy to provide you with their contact information. No sense in paying Uncle Sam taxes if you don’t have to!

***************************************************************************

The good news for May home sales in our Great Hills neighborhood (2-3k sf homes) is that this is the first month of 2020 where we didn't have any yellow categories! Our inventory stayed low; we got 3 sales (our best of the year) and they got an average of $261.68/sf (+11.3% over 2019!).

Larger homes in our neighborhood didn't fare as well, but at least there is a glimmer of hope and green categories like we started the year. We have a few too many homes for sale and they've been on awhile, but we got 2 pending sales (believe it or not, our 1st month this year) which pushed up our Activity Ratio to 40%.

COVID-19, in effect, pressed “pause” on our Austin metro for 6 weeks from the middle of Mar thru the end of April. Prior to that and since, our pending sales have been higher than 2019 numbers. So, COVID-19 really just pushed our typical spring selling season back 6 weeks. It is NOT too late to get your home listed and sold this year since we believe it will be an extended season. If you are interested to know your home’s value, click “What’s My Home Worth?”.

*************************************************************************

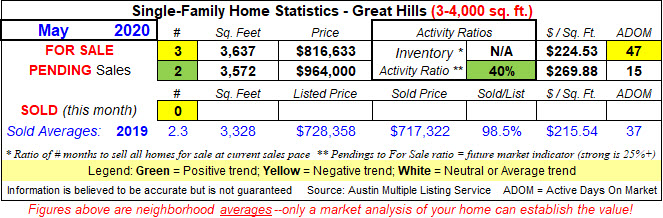

April presented a big test for our Austin real estate market since it was the first full month of sales data that had the full effect of the COVID-19 virus. Surprisingly, April home sales data for our Great Hills neighborhood (2-3k sf homes) neighborhood actually went UP from March which was only partially affected by COVID-19.

For instance, we had 5 green categories in April vs. 1 in March. We had our best month of 2020 in pendings; inventory remained low; and our sellers got 2.2% OVER their asking price at 11.8% more/sf than 2019 sellers in only 3 days!

For larger homes in our neighborhood (3-4k sf) we had 1 green (vs. none in March) and 4 yellows (vs. 5 in March) so we had marginal improvement, but it was improvement, nonetheless. And, our seller did get 11.1% more/sf than 2019 sellers received.

The bottom line: If you need to sell your home this year, do as we always have by getting it in good shape, staging it properly, price it well and use the best photography/virtual tours you can find so buyers have the option to tour your home virtually if that is their preference (Survey: Quarter of Consumers Accept Virtual Home Buying).

All of my listings for sale use Matterport technology which provides photos, digital virtual walk-thru tour, 2D and 3D floor plans, dollhouse view and more to make it easy for a home buyer to look at the home from the comfort of their home. “Buy your next home from the comfort of your home!”

****************************************************************************

Not sure what's going on with homes sized 2-3k sq ft in our Great Hills neighborhood this year, but it is quite different than 2019 when we had 9 sales in the 1st quarter (vs. 4 this year). Especially when you compare to 2-3k sq ft homes in the somewhat similar nearby Spicewood/Balcones neighborhood that has sold 13 homes this quarter and in the 1st qtr of 2019.

Larger homes in our neighborhood have fared even worse with only 1 sale this quarter and no pendings in any month. It baffles me why Great Hills is having these problems this year.

COVID-19 began to have an effect on our local economy when the order to Shelter in Place took effect in the Austin metro on March 24th (Texas and the U.S. government suggesting smaller groups before that) so it will be interesting to see the April results when the full month will be affected.

I hope you and your family haven’t been directly affected by this virus, economically or health-wise. It is refreshing to hear our leaders begin to talk recently about ways to get us back to work and a more normal life, too.

***********************************************************************

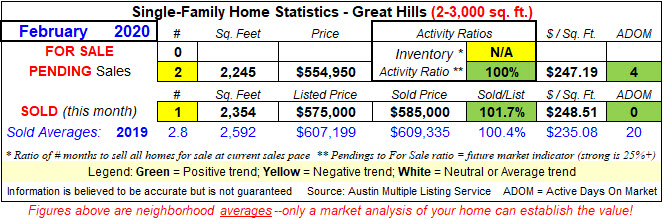

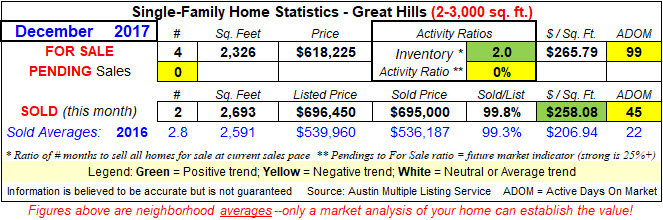

Our Great Hills neighborhood continues to struggle this year with another poor performance in February: no homes for sale; only 2 pending sales (vs. 2.8/mo last year); and only 1 sale (vs. 2.8/mo avg last year). We did have lower days on market in 2 categories and our seller received 1.7% MORE than their asking price, however.

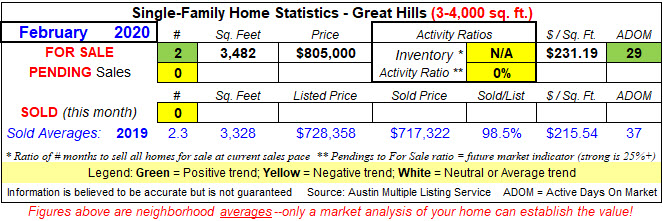

Larger homes in our neighborhood fared worse: no pendings (3rd month in a row); no sales (after only 1 in Jan) and no activity ratio. Not sure what's happening in Great Hills, but hopefully, it picks up soon.

March, April and May are the 3 biggest months each year in Austin for sellers to list their homes for sale. Are you thinking of selling this year? Did you know that you can receive up to $250k for a single person ($500k for a couple) of gain from the sale of your house INCOME TAX FREE?! Here is the link to the IRS site with more information: Gain from Sale of Residence. Contact us at 512-853-0110 (phone/text) or info@AustinTxHomeSales.com to learn more.

************************************************************************

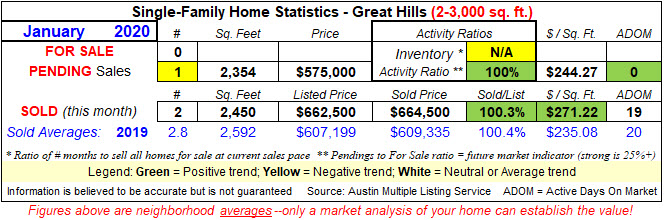

January was a rather flat month for home sales activity in our Great Hills neighborhood (homes sized 2-3k sq. ft.) with only 1 pending sale (vs our 2.8/mo avg in 2019) and no homes for sale (out of 1,168 in our neighborhood). On the plus side, our 2 home sellers got OVER their list price and at $271.22/sf (+15.4% over 2019 sellers)!

Larger homes in our neighborhood fared about the same with only 1 home for sale (which represents only 1.0 months of inventory); no pending sales; only 1 sale which sold for only 95.6% of their asking price in 49 days at $198.36/sf (8% LESS than 2019 sellers). Hopefully, things pick up as 2020 progresses.

If you are considering selling this year, contact us to receive a free, no obligation market analysis (CMA) for your home. March, April & May are the most popular months to list a home for sale. Call/text us at 512-853-0110 or by email info@AustinTxHomeSales.com to receive yours today. See just some of the steps we take to get your home sold quickly and for top dollar: Marketing Plan to Sell Your Home.

*************************************************************************

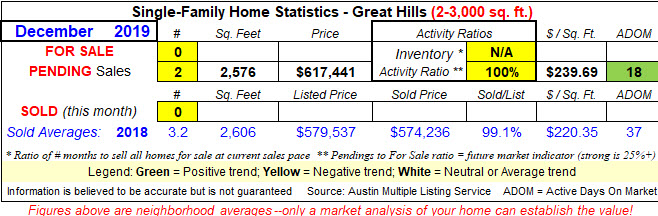

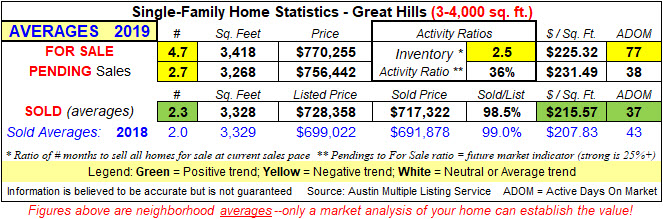

Unfortunately, both November and December were some of the worst months of 2019 in our Great Hills neighborhood (2-3k sf homes) so it wasn't a great way to end the year: We had no home sales or homes for sale (out of 1,168 homes...a low inventory is good for sellers, but no inventory isn't); and we only had 2 pending sales (vs. our YTD 2.8/mo avg). Hopefully, things will pick up in January.

For all of 2019, here are our averages:

Quite a difference from Nov/Dec, right?! And our only yellow was only off the YTD avg by 11%, so not too bad. This shows just how strong a year we really had in 2019!

Larger homes (3-4k sf) in our neighborhood fared about the same as the smaller ones: No homes for sale or pending sales so no activity or inventory; our 2 home sales was close to our YTD avg/mo of 2.25 but took nearly twice as long (64 days vs 37) to sell.

For all of 2019, here are our averages:

2019 wasn't quite as good a year for larger homes in our Great Hills neighborhood, however, with 4 categories in yellow.

If you are considering selling this year, please contact me to receive a free, no-obligation market analysis (CMA) for your home. March, April & May are the most popular months to list a home for sale. Call me at 512-853-0110 (phone/text) or by email robert@AustinTxHomeSales.com.

**********************************************************************

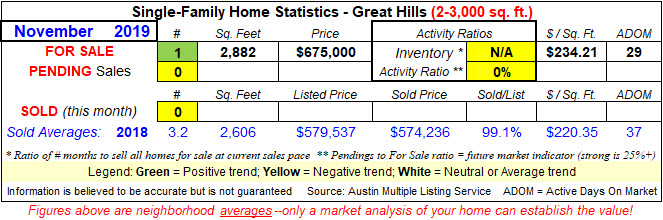

November home sales in our Great Hills neighborhood (2-3k sf homes) were simply not good: we had no pending sales or home sales at all...this hasn't happened since I began tracking numbers in 2012. We've had months were we didn't have one or the other, but never both in the same month. The one bright spot is we only have 1 home for sale going into the slower winter months.

With the exception of higher days on the market, larger homes in our neighborhood (3-4k sf) fared much better than smaller homes with: only 1 home for sale; .50 months of inventory (vs. our 2.5/mo YTD avg) and our Activity Ratio shot up to 75% (vs. our 36% YTD monthly average).

Did you know you can exclude most, if not all of the taxable income from the gain on the sale of your home? The IRS allows a seller to exclude from taxable income a gain of up to $250,000 on the sale of their home (or $500,000 if married filing jointly) if they:

-

owned the home and used it as their principal residence during at least two of the last five years before the sale

-

didn’t acquire the home through a 1031 exchange during the past five years

-

didn’t exclude a gain on another home sold during the two years before the current sale

To learn more, see: Excluding Gain from the Sale of Your Home. It might make sense to cash-in on the large equity gain most Austin-area homeowners have seen since the bull market began in spring of 2011. Contact us today by phone/text at (512) 730-1252 or via email at info@AustinTxHomeSales.com if you would like a free, no-obligation market analysis (CMA) of your home to see how much you would net from the sale.

*****************************************************************************

The only real negative for home sales in our Great Hills neighborhood (2-3k sf homes) was the fact that we didn't have any pending sales (ie-have contract but not closed). Otherwise, we did have lower inventory levels and more homes sold (5 vs. our YTD avg of 3.4).

Larger homes (3-4k sf) didn't fare as well with higher days on market for all 3 categories; lower Activity Ratio; and only 2 pending home sales. Our inventory did drop, however, and we sold 4 homes (vs. our 2.3/mo YTD avg) that received 8.5% more/sf than 2018 sellers received.

For those home sellers who aren’t sure about selling this year, or just want a general idea of their home’s value, we recommend the “Market Snapshot” program. This free service pulls data from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to the homeowner. Create one yourself for your home here: Market Snapshot. It takes about 30 minutes to receive your report. Or, let us know if you–or someone you know–wants me to create a Market Snapshot for their home.

We also have a similar program we can set up for you (or a friend/relative) even if you own property in another state. It’s called ePropertyWatch. Let us know if you would like that, too.

************************************************************************

September gave us pretty good results for homes of 2-3,000sf in our Great Hills neighborhood considering fall/winter months usually show signs of a slowdown. Days were long on 2 categories, but we only had .50 months of inventory and had above average sales.

Larger homes in our neighborhood saw more normal results, however, with a high days on market for homes currently listed, but lower for pending sales.

Did you know that 42% of homes sold in the Austin metro area sell during the 50% of the year from October to March? A common myth is that you should only sell your home during the spring/summer months, but the above statistic proves that wrong. Homes that are in great condition, staged properly and priced right sell year-long in our area. Call/text the Thomas & Kauffman Team at 512-730-1252 or email us at info@AustinTxHomeSales.com to get your free, no-obligation market analysis (CMA) to see how much you can net from your home sale.

**************************************************************************

August brought decent sales numbers for homes in our Great Hills neighborhood (2-3k sq. ft. homes) with: only .60 months of inventory (down from our .90/mo YTD avg) and we sold 5 homes (vs our 3.13/mo YTD avg) at 6% more/sf than last year's sellers received. Our only real negative was that days on market were higher for all 3 categories.

Larger homes in our neighborhood fared about the same with only 2.0 months of inventory (down 1/3 from our YTD avg); days on market went down in 2 categories; our our 3 sellers got a whopping 10.8% MORE/sf than last years sellers received!

Offering ammunition to agents who argue that iBuyers are often deceptively expensive, a new study by real estate data analyst Collateral Analytics has determined that the typical cost of using an iBuyer ranges between 13 and 15 percent. Entitled “iBuyers: A new choice for home sellers but at what cost?” the study conflicts with claims made by some iBuyers on just how expensive such services wind up costing homeowners. Opendoor, for example, represents its service as more affordable than a real estate agent. But if the new research is correct, using an iBuyer would generally cost consumers two to three times more money than if they simply used a traditional agent. This is right in line with the numbers we reported in this blog a few weeks ago with one of our own sales: “Quick-offer” company loses home sale. Contact the Thomas & Kauffman Team so we can discuss your particular situation if you are thinking of selling.

Full Article here: iBuyers cost sellers up to 15% of a home’s value, study finds

Contact the Thomas & Kauffman Team today if you would like to buy or sell a home in the Austin metro area – (512) 730-1252 or info@AustinTxHomeSales.com.

*****************************************************************************

July was a mixed bag like June was in our Great Hills neighborhood (homes 2-3k sq. ft.) with higher pending sales; lower days on market for actives and our 3 home sellers got an incredible 12.0% more/sf than last year's sellers received. We have a few too many homes on the market; inventory is up; and our activity ratio dropped are our negative areas.

Larger homes (3-4k sq. ft.) didn't fare as well with only 1 green (ie-positive trending) category and the rest negative-leaning like: too many homes for sale, days on market up in 2 categories, activity ratio down, inventory shot up to over double our YTD avg of 3.2 months and we only sold 1 home at 1.6% LESS than last year's sellers received.

For those home sellers who aren’t sure about selling this year, or just want a general idea of their home’s value, we recommend the “Market Snapshot” program. This free service pulls data from our MLS (Multiple Listing Service) for similar homes in your neighborhood on a regular basis (every 2, 4, 6, 8, or 12 weeks) and emails it to the homeowner. Create one yourself for your home here: Market Snapshot. It takes about 30 minutes to receive your report. Or, let us know if you–or someone you know–wants me to create a Market Snapshot for their home.

We also have a similar program we can setup for you (or a friend/relative) even if you own property in another state. It’s called ePropertyWatch. Let us know if you would like that, too.

**************************************************************************

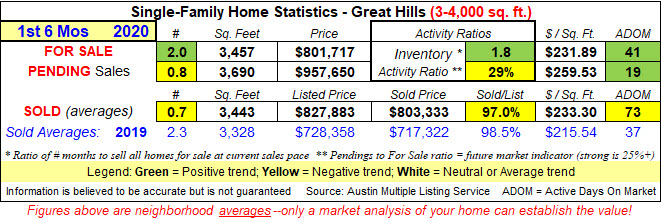

Overall, a pretty good month in June for our Great Hills home sales (2-3k sf) with: days on market for 2 categories dropping nicely; 4 Pending sales is above our YTD avg; and our 3 sellers received 2.7% OVER their asking price at 10.7% more than 2018 sellers received. Our negatives were: too many homes for sale, inventory slightly up, and days on market for our pending sales is up.

Looking at the 1st 6 months of this year: The number of homes for sale each month, days on market for all 3 categories, dropping inventory, and higher Activity ratio are all much improved over last year.

The brakes really went on for larger homes in our neighborhood in June, however: Higher number of homes for sale; days on market up in 2 categories; only 1 Pending sale; extremely low Activity ratio; and our 3 sellers received 2.9% LESS/sf than last year's sellers received.

For the 1st 6 months of 2019: Pending sales are more than double last year and days on market are down significantly in 2 categories. However, the average number of homes for sale is more than double and our inventory is up 71% over last year.

184 Things Real estate Agents Do To Earn Their Commission Surveys show that many homeowners and homebuyers are not aware of the true value a REALTOR® provides during the course of a real estate transaction. At the same time, regrettably, REALTORS® have generally assumed that the expertise, professional knowledge and just plain hard work that go into bringing about a successful transaction were understood and appreciated. Listed here are nearly 200 typical actions, research steps, procedures, processes and review stages in a successful residential real estate transaction that are normally provided by full service real estate brokerages in return for their sales commission.

Contact the Thomas & Kauffman Team if there are any real estate questions or needs you have: by phone/text at (512) 730-1252 or via email at info@AustinTxHomeSales.com.

****************************************************************************

Activity fell off a bit in May for homes in our Great Hills neighborhood (2-3k sq ft homes): We had 4 homes for sale (vs our YTD avg of 1.8); which pushed inventory up to 2.0 months and our Activity ratio down to 50%; but, we had more pending sales; days on market fell with 2 categories; and our 2 home sellers got 4.1% OVER their asking price in only 4 days and at 6.6% more than last year's sellers received.

With the exception of days on market which jumped in May, larger homes in our neighborhood fared better with: only 3 homes for sale (vs. our 4.6/mo YTD avg); our inventory dropped to only .80 months (our best this year); our Activity ratio jumped to 57% (our best this year); and we sold 4 homes (double our YTD avg of 2.0).

It’s not too late to get your home on the market to catch our spring/summer peak selling season! See just some of the steps we take to get your home sold quickly and for top dollar: Marketing Plan to Sell Your Home. Contact us today by phone/text at (512) 730-1252 or via email at info@AustinTxHomeSales.com if you would like a free, no-obligation market analysis (CMA) of your home to see how much you would net from the sale.

****************************************************************************

The 2nd quarter of 2019 starts off with a solid month for home sales in our Great Hills neighborhood: only 1 home for sale which kept inventory low at only .30 months; our 2 pending sales only took 4 days to get under contract; and our 3 home sellers got 5.0% more/sf than 2018 received. We only had 2 pendings and our home sales took longer (28 days) to get offers, though.

April was a better month for larger homes (ie-3-4k sf) in our neighborhood, too, with: 6 pending sales (4 times our 2018 avg); 50% Activity ratio; and our 2 home sellers got offers in only 7 days at 10.2% more/sf than 2018 sellers did and at 3.7% OVER their asking price!

Did you know you can exclude most, if not all of the taxable income from the gain on the sale of your home? The IRS allows a seller to exclude from taxable income a gain of up to $250,000 on the sale of their home (or $500,000 if married filing jointly) if they:

-

owned the home and used it as their principal residence during at least two of the last five years before the sale

-

didn’t acquire the home through a 1031 exchange during the past five years

-

didn’t exclude a gain on another home sold during the two years before the current sale

To learn more, see: Excluding Gain from the Sale of Your Home. It might make sense to cash-in on the large equity gain most Austin-area homeowners have seen since the bull market began in spring of 2011. Contact us today by phone/text at (512) 730-1252 or via email at info@AustinTxHomeSales.com if you would like a free, no-obligation market analysis (CMA) of your home to see how much you would net from the sale.

*******************************************************************************************************